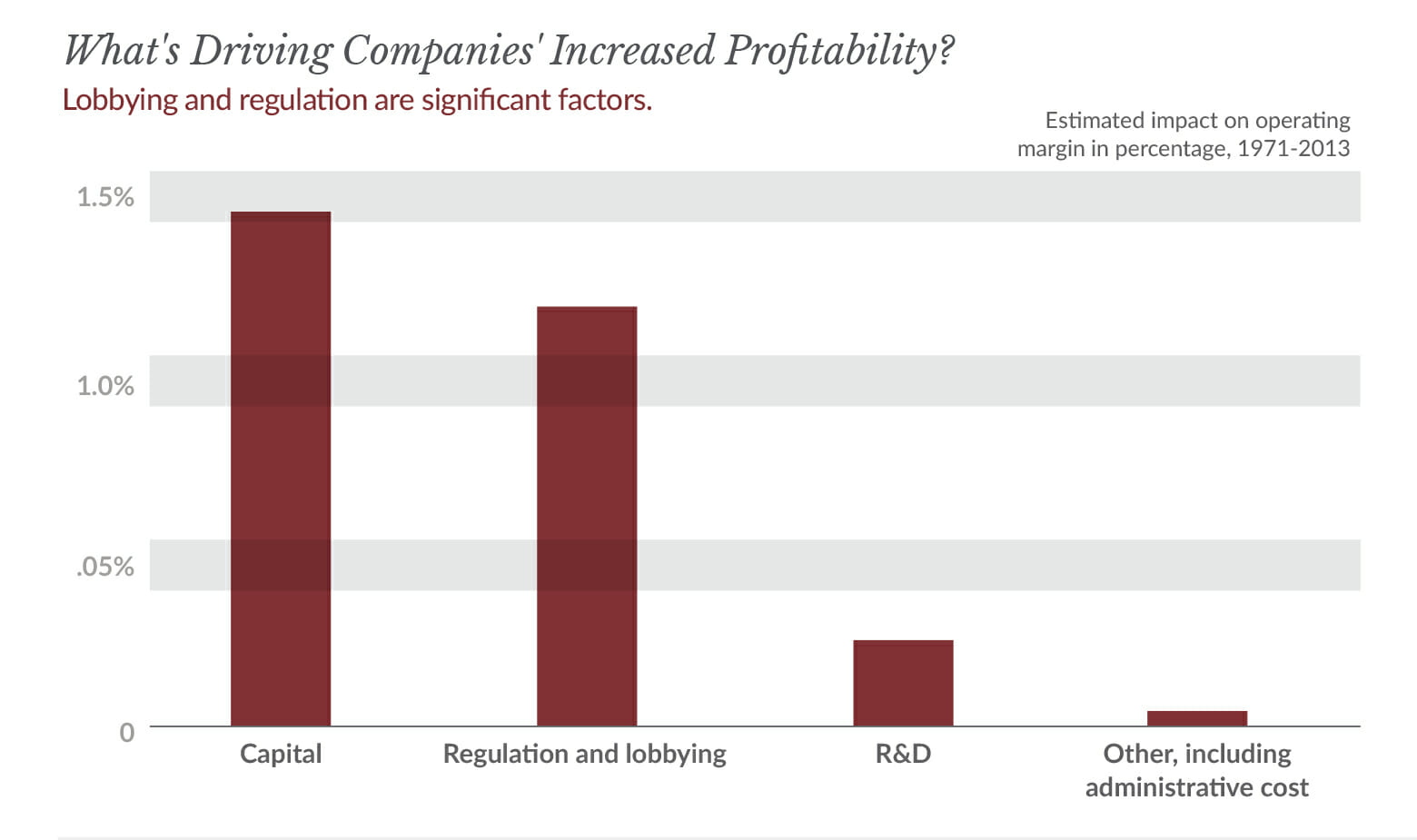

Investors often look for companies that have an edge – killer management, a tough-to-duplicate product or brand loyalty to name but a few. One often overlooked advantage is a company’s skill at influencing government policy through lobbying and public affairs efforts. One dollar spent lobbying for tax breaks, for example, can return more than $220, according to a Harvard Business Review study.

Effective lobbying is especially important today, as the Trump administration and GOP controlled Congress look to remake virtually every aspect of the regulatory landscape. But identifying corporations that effectively make their case with lawmakers and regulators can be difficult for individual investors.

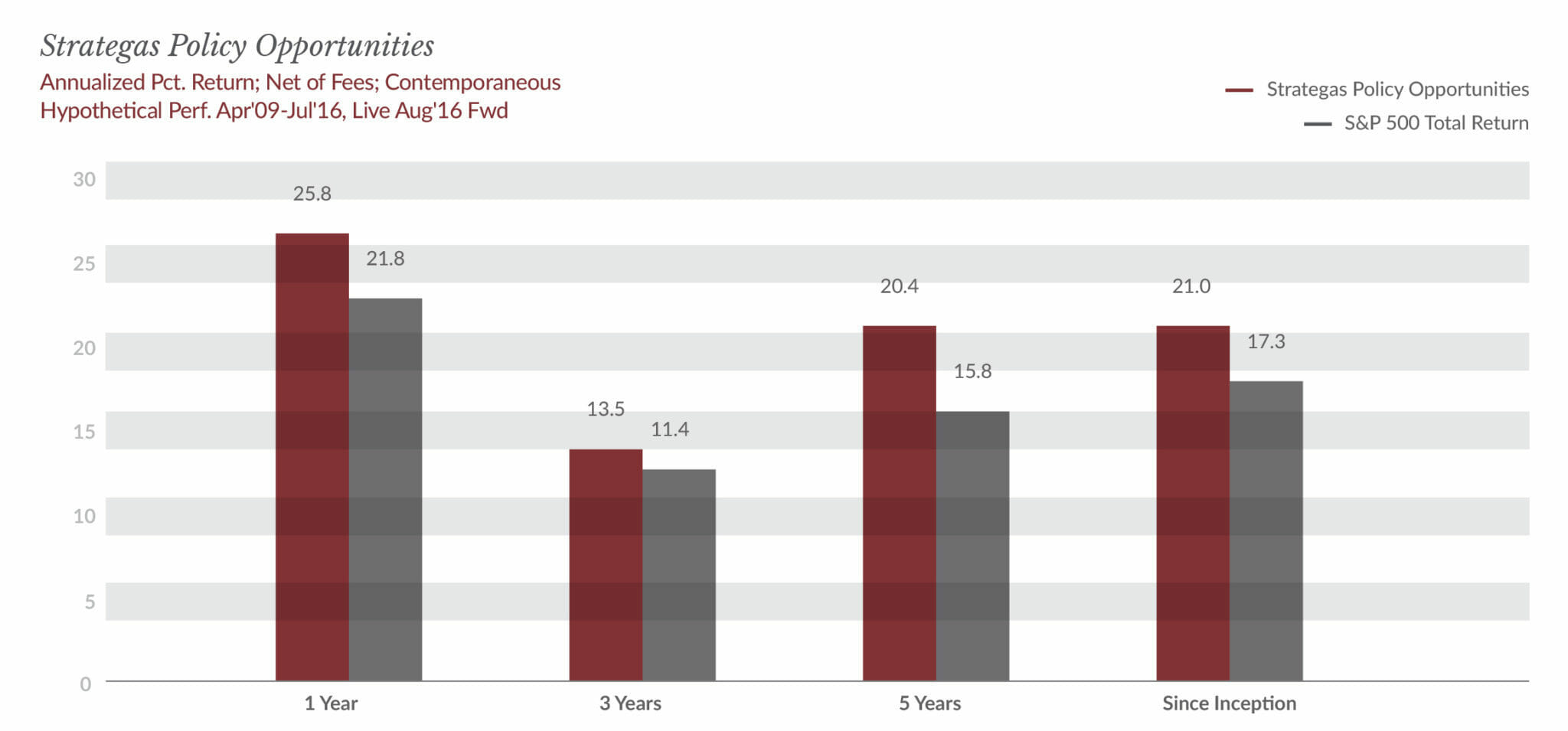

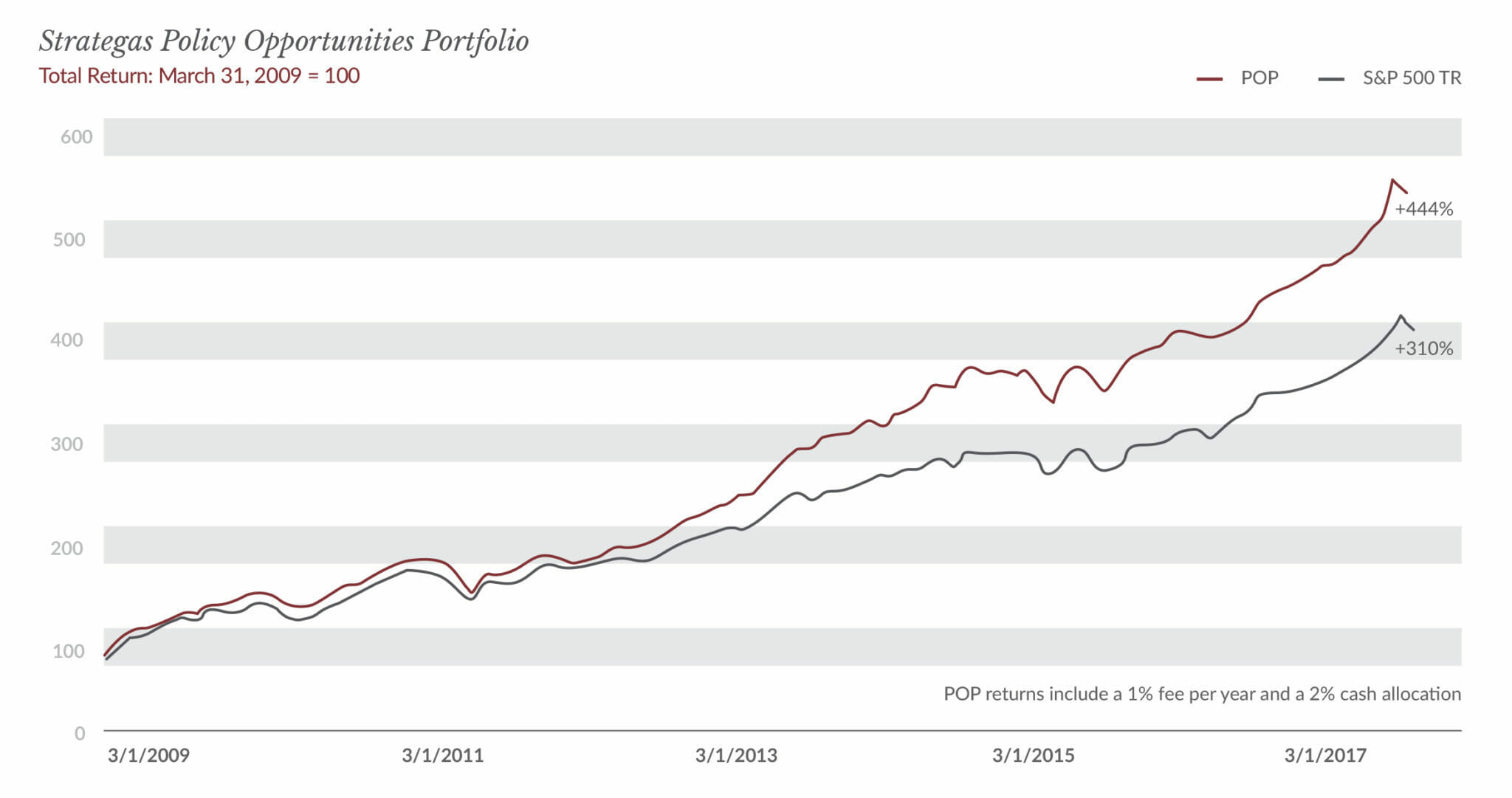

That is, until now. The Strategas Policy Opportunity Portfolio (POP) is a basket of 50 U.S. companies that generally outpace their peers in a sophisticated metric known as Lobbying Intensity (LI). POP’s LI analysis has an impressive track record. Since POP’s creation in April 2009, the portfolio has outperformed the S&P 500 by nearly 4% per year on average (20.6% vs 16.8%). On a year-to-year basis, POP has eclipsed the S&P 500 in eight out of nine years (2009 – 2017).1

The Policy Opportunity Portfolio was backtested to 2002, and again held its performance versus the S&P. This result is evidence that, regardless of which party controls the White House and Congress, the factors that determine a company’s inclusion in POP remain unaffected; the LI metrics uncover companies that find success in Washington, no matter the current political climate. That said it is important to understand that backtested portfolios have the benefit of hindsight. Future results will not be consistent with backtested results.

The 50 stocks included in POP are divided evenly between income and growth shares.

All 50 component companies are established businesses that are significantly impacted by Washington’s actions and stand to see increased earnings from favorable decisions by Congress, the White House and the alphabet soup of regulatory agencies.

POP’s income holdings, which have a yield of 3%, include a wide variety of companies including aerospace and defense manufacturers, semiconductor makers and companies that produce truck engines. The growth portion of POP includes such companies as a medical equipment company, technology companies, and pharmaceuticals.

The LI calculation takes into account not only how much a company spends on lobbying but the size of that expenditure relative to the corporation’s market capitalization, revenue, and earnings. This is important in assessing the potential ROI of a lobbying investment.

The size of a company’s lobbying budget isn’t the only factor in determining effectiveness.

The LI calculation also tracks the component companies’ public relations work, changes in public attitude on issues impacting the companies, and other factors that may influence a future benefit to earnings.

The firms with solid lobbying efforts are often good at seeing the big picture regarding how regulation will affect their business. For example, an astute corporation might support (or not oppose) a strict new regulation because, while it might increase costs for the company, it would also create a new barrier-to-entry for would-be competitors.

Big Tobacco used exactly that strategy in 2005-2006 when the industry was facing a wave of class-action lawsuits. In response, the cigarette companies pushed hard for more government regulation and reform. They eventually accepted limits on their marketing efforts and new taxes in exchange for protection from the lawsuits. That deal might be considered a win-and-a-half for Big Tobacco as the advertising limits and higher taxes created a barrier-to-entry for would-be cigarette makers.

POP offers investors a way to invest in large-cap companies that have a perceived quantifiable edge on their competitors.

It’s tough to out-perform the S&P 500, but POP’s mix of income and growth equities offers investors a good strategy to attempt that. Large-cap stocks typically make up 30%-40% of a well-balanced portfolio. Using POP for that piece of the pie gives an investor a stake in 50 companies that have a strategy on both Wall Street and Pennsylvania Avenue.

As always, speak to one of our advisors to determine if the POP is a good strategy for your specific situation.

1The Strategas Policy Opportunity Portfolio was a hypothetical portfolio with backtested performance from January 2014 to July 2016. Actual performance did not begin until August 1, 2016. Therefore, hypothetical portfolios have the benefit of hindsight and can positively affect the outcome of performance that would not have otherwise been experienced. Actual performance of the portfolio has fluctuated, and a client will experience periods of higher or lower performance.

The information contained in this article is provided to you as a resource for educational purposes only and should not be considered investment advice or recommendation. Past performance is not indicative of future results when considering any investment vehicle. It is not known whether any person investing in the Strategas Policy Opportunity Portfolio has achieved their investment goals. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and for informational purposes only and it is not known whether the strategies will be successful. There are many aspects and criteria that must be examined and considered before investing.