Dividends are a way for a company to return some of its profits to shareholders. They’re cash payments that certain companies give to investors. Each allotment is often paid out as small amounts per share.

There’s a story I like to share about my son Jake. He saw a dollar coin on the ground, and lying next to the dollar coin was an old penny, which he did not retrieve. “Jake, what about the penny?” I asked. “Dad, a penny doesn’t even buy a piece of candy these days,” he scoffed.

Jake’s catch-and-release treasure hunt was an awakening for me — the youth have no love for the coin of the realm. Instead, it’s all about the Benjamins. Or, at least, the Washingtons. In the case of stock dividends, however, cents make a lot more sense.

How Dividends Work

For example, it’s not uncommon for a company to pay its dividend as fifty or sixty cents per share, divided into four quarterly payments. Unfortunately, the public, like my son, Jake, can sometimes neglect to appreciate such a decimal point of distribution. After all, does the spare coin jar really make a difference to your bottom line?

Perhaps an even more ignored creature is the dividend increase, typically only a few cents more in any given year. For example, if you own stock in a company that pays a dividend of fifty-seven cents per share, they may announce a dividend increase of four cents to sixty-one cents. That means you get an extra four cents for each share you own.

What’s the big deal? It’s only four cents, right?

It might look that way at first, but four cents on fifty-seven cents is a 7 percent dividend increase on each share you own. If it went up by this amount every year, it would only take about a decade to double. Yes, double. In other words, if you stick with dividends, dividends typically stick with you.

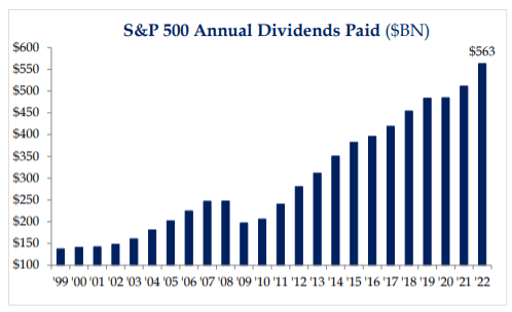

Though a micro view focuses on the modest payouts, the macro perspective reveals that S&P 500 companies alone paid out $563 billion in dividends to shareholders in 2022.

Are the pennies adding up yet?

Source: Strategas

These figures date back twenty-five years, a quarter of a century! The journey takes us through the dot.com bust, the Great Financial Crisis, COVID, and 2022’s interest rate hikes. The S&P 500 dividends in aggregate have only dipped year-over-year once, between 2008 and 2009, when they dropped from $246 billion to $197 billion. They’ve so consistently increased each year that not even COVID could stop them.

The Study: Dividend Income vs. Bond Interest

As a reminder, bonds are essentially IOUs issued by governments or companies. Investors buy these loans, and the issuer promises to pay them back in full, plus interest, along the way. So the risk is typically lower than equities, but so often is the reward.

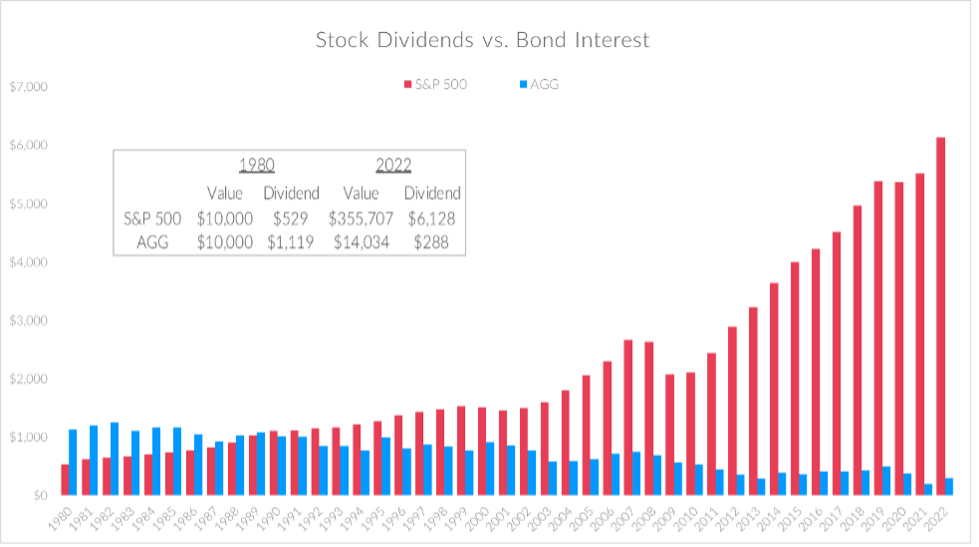

How does bond interest stack up against the income-producing power of stock dividends? Examining a $10,000 investment in the S&P 500 vs. the Aggregate Bond Index, my team at Capital Investment Advisors charted the results over more than forty years. In each case, investors left the principal alone while taking the income produced each year by the dividends.

The table below shows what happened over time with each investment.

Comparing Investments

Source: Bloomberg data; Capital Investment Advisors

In 1980, a $10,000 investment in the S&P 500 paid a dividend of about $529, 5.29 percent of the initial investment. Forty-three years later, the dividend income had climbed to $6,128 — a 61 percent annual yield on the original investment.

Don’t forget that the original investment grew as well. For example, if you had invested $10,000 in the S&P 500 in 1980, it would have flourished into more than $355,700, not even incorporating the dividend income you received each year.

On the other hand, the Aggregate Bond Index only grew from $10,000 to $14,034 and would now pay out just $288 per year, or 2.88 percent of your investment. It’s clear that income from stock dividends outpaced bond interest. Annual stock dividend income increased over 11.6 times in price, while the remaining price-only return grew thirty-five times. On the other hand, bonds rose less than 1.5 times in price, with about a 75 percent reduction in income.

Whether your retirement portfolio holds $500,000 or $5 million, it’s hard to find a more consistent source of sprouting income to outpace inflation than dividend-paying stocks.

The Verdict: Dividends Are a Powerful Wealth-Building Source That Should Not Be Ignored

The statistics above can be frustrating for unaware investors, but let the knowledge guide your future decisions rather than fill you with regret. For example, if you’re forty or fifty, you still have three to four decades to invest. So you have more years of spending ahead of you than you might think.

Look for stocks that are perennial dividend payers and consistent dividend growers. Then be patient, and watch the dividends roll in over time. Remember, despite price fluctuation, dividends from established American companies tend to remain relatively steady, even in tumultuous years like 2020 and 2022.

Act calmly and with purpose. You’ll find that those pennies start adding up over the years, and you’ll be happy you picked them up. The pursuit of dividends can be a rewarding endeavor for any investor with enough long-term vision to let the spare coins turn into treasure.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. There will be periods of performance fluctuations, including periods of negative returns and periods where dividends will not be paid. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,