Recently, I had the pleasure of hosting Atlanta Federal Reserve Bank CEO and President Raphael Bostic on my podcast. Our conversation elucidated many of the critical jobs of the Atlanta Fed. During the interview, Bostic educated me on the multi-layered process and purpose of the Fed.

Since then, I’ve made a few trips to the Atlanta Fed, mostly for speaking events and things like that. But during my last visit, I took the guided tour, and let me tell you it was astonishing. I’ve never seen such massive bundles of money.

I’m talking cash by the billions.

One of the many jobs of the Fed is to refurbish cash. And all of this money (and the process each bill goes through) was on display through a glass wall that I’m guessing was at least two feet thick.

Here’s how it works. The big banks send their cash to the Fed by the truckload. Once it arrives and is processed in, the bills go through a sorting machine that pulls out damaged or potentially counterfeit bills. Through this process, the Fed makes sure our currency is in tiptop shape. Damaged bills go to the shredder, while the perhaps counterfeit ones are turned over for the Secret Service to investigate. (Quick history: the Secret Service was originally commissioned to fight counterfeiting.)

You can watch as they “refresh” our currency, and it’s almost surreal. There are robotic canisters on wheels filled with money and massive vaults to store it all. It’s truly fascinating.

This is but one of the many jobs of the Atlanta branch of the Federal Reserve System. And, as we all know, there are many things that the Federal Reserve Bank does.

The job we’re most interested in today (as is the case for most days) is how they keep the economy running smoothly. They do this (or try to, of course) by way of setting interest rates. When we’re in a downturn, the Fed will lower rates to boost the economy. The inverse is also true – when we’re flying high, the Fed hikes rates to make sure we don’t get runaway inflation.

I’ve come across some noteworthy and timely data on the impact of lowered rates from the Fed.

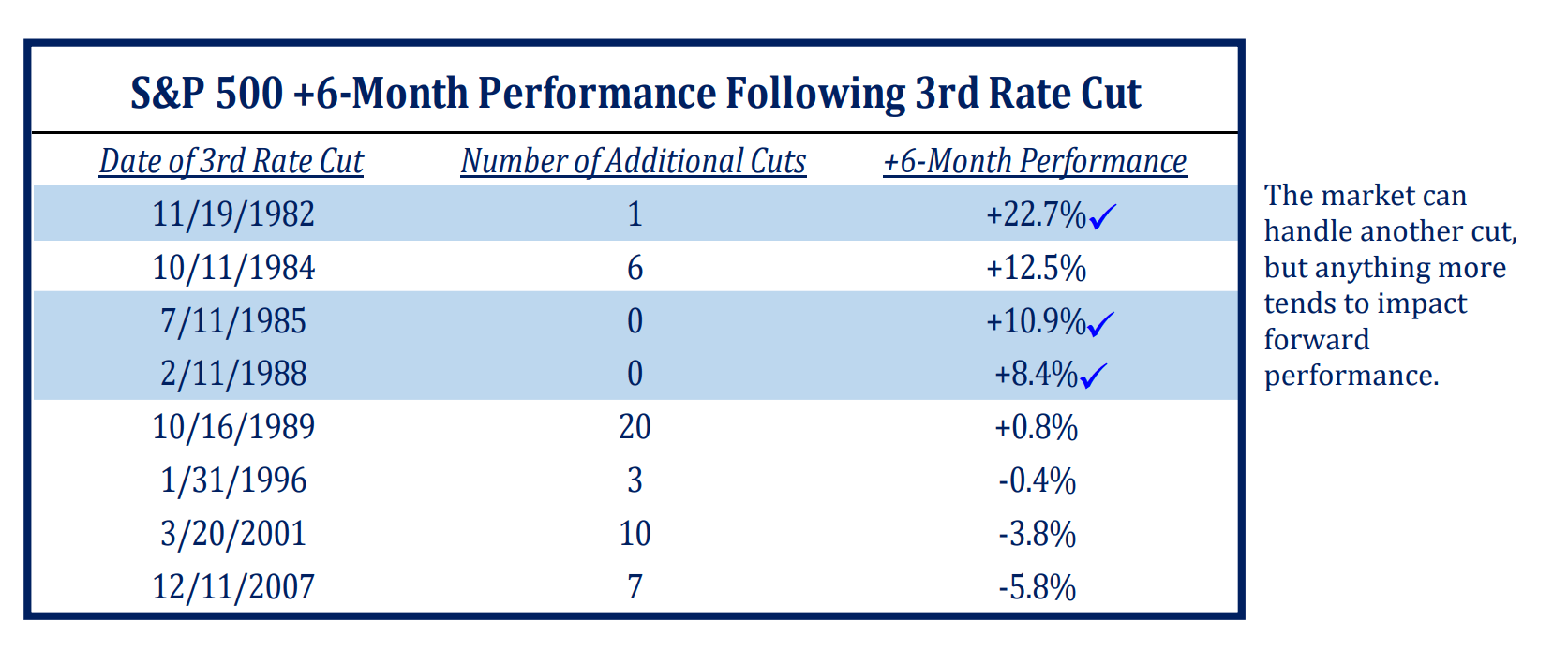

This data comes to us from our friends at Strategas, and illustrates how markets react to interest rate cuts. Since 1982, there are eight instances where the Fed has cut interest rates at least three times without any hikes in between. According to numbers, when the Fed lowers interest rates three or four times and then stops, the stock market tends to do well for the next six months.

As you can see from the above, following the third cut, if they stop or make just one more, the economy tends to do well for the next half-year or so. But, if they make multiple cuts after, the market doesn’t fare as well.

Today, it appears that markets are reacting positively to the Fed’s announcement that we may be “good to go” for a while on rate movement. After all, markets like certainty. As Bostic said during our interview, stability helps consumers and business owners make informed and confident financial decisions. And that’s a driving force behind how we do economically.

It makes sense – if the Fed can make just a few cuts to keep things on track, it means they have done their job and corrected our course in relatively short order. The economy forges ahead, and the markets like it.

If interest rates hold (meaning that the Fed doesn’t make additional cuts anytime soon), we could continue on our current trend. These recent weeks have been very positive for stocks. And, looking back to the data, six months after a three cut cycle (or a four cut cycle, but no more) stocks go up an average 14%.

This could be the case today, as the Fed seems to believe they’re finished with lowering rates for at least a while. And, they don’t seem to be inclined to raise rates, either, unless inflation gets to a tipping point. But we’re not there yet. Right now, we’re in the sweet spot – three cuts and no more on the imminent horizon. It’s a good place to be.