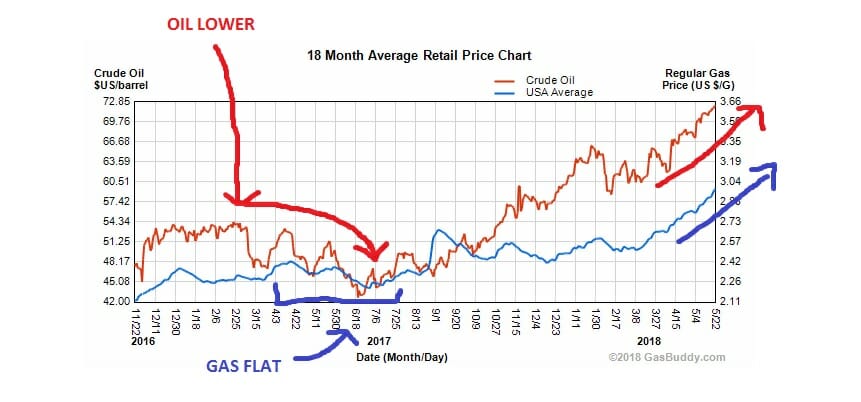

No doubt you’ve noticed that prices at the pump are on a one-way street upwards. It’s not your imagination – the price of gas has risen as the price of crude oil continues to balloon. For perspective, this time last year gas prices were relatively flat, with the corresponding price per barrel of oil averaging around $51, give or take. Since March of this year, though, we’ve seen increases in the price for a fill up as crude oil hovers around the $64 per barrel mark.

I hear you. The price of gasoline is taking a toll on your wallet, and we’ll get to that in a moment. But first, let’s talk about how the rising cost of oil for consumers impacts the engine of our US economy.

Some folks worry that a continued rise in gas prices will offset the economic benefits of the recent tax overhaul. Is this a legitimate concern? Let’s do the math.

If we continue to hover around the $64 price point, we’d see a related 9.6% increase in US consumer spending on energy. In 2017, Americans spent approximately $530 billion in the energy sector. Applying the 9.6% increase, our spending could increase to about $580 billion for 2018. So, we’re talking about a $50 billion annual change, or, more aptly perhaps, a $50 billion hit to consumer purchasing power for this year.

But here’s the good news. The new tax bill will be a $120 billion boost for US consumers in 2018, according to Dan Clifton, Head of Policy Research at Strategas. Even if Americans spend extra at the pumps this year and increase total energy spending by our $50 billion estimate, that hit will be more than offset by the tax boost.

Oil prices would need to hit $87 per barrel to erase the benefit of tax reform. Fortunately, that price point is nowhere in sight.

By the way, don’t expect pump prices to quickly tumble if and when the price of oil falls again.

Here’s why:

Gas station owners (GSOs) make very little profit from actually selling gas. While GSOs may mark up a gallon of gas by 10 cents, after paying for credit card fees, employee salaries, and rent/mortgage payments, their actual profit may be as little as two cents per gallon. Still, you say, they sell a lot of gas! True. But even considering that the average gas station pumps about 4000 gallons a day, that only gets your average GSO to 80 bucks for the whole day.

So, how do they make their profits? From the sale of concessions. The GSOs bread and butter comes from drivers who stop in for sodas, snacks, and cigarettes. If you think about where their profit is, it would seem that gas is just the bait to lure you in to buy the real profit drivers. And when oil prices go up – and the cost of their gas goes up – GSOs will actually absorb some of the initial price surges, meaning their gas profits get squeezed further, just to continue luring drivers inside.

And then comes the day that gas prices begin to fall; this is the day (or days) that GSOs get the chance to increase their gas profit margins. While they are paying less for gas, they are slow to lower prices, and typically won’t until the station across the street does.

The refinery process is also a culprit in keep gas prices up long after the cost of oil has dropped.: The oil has to get extracted, then be transported to a ship, then shipped to the US, and then go through a series of pipelines and tankers to get heated and treated where it finally becomes good ol’ gasoline. We’re not done yet. That gasoline then must be transported through pipelines and tanker trucks before it is sold to your neighborhood GSO – a process that in itself can take weeks.

And then, there are factors beyond our control. Remember the Mississippi floods that threatened an enormous amount of refining capacity? Because 13% of oil refineries in the US are located between New Orleans and Baton Rouge, this unpreventable act of nature pushed up the prices of gas even though the price of oil had already dropped by almost 15%.

As you can see, the dynamics here are relatively complex. Our bottom line is that the price of gas will move with the price of oil – eventually. And eventually is the operative word here. Gas prices tend to rise slower than the price of oil, and, on the flip side, they tend to take their time falling as the price of oil drops. My advice? Make use of those fuel points as often as you can.

Check Out: What You Need To Consider Before Buying A Vacation Home