Maybe I listen to too much financial radio, but I’m getting tired of the frequency and questionable claims of commercials hocking gold.

Some of them make no sense:

“Convert your old, forgotten paper 401k into a pot of solid gold!” Who forgets about their 401k? It’s most Americans’ largest asset next to the value of their home. And why are your 401k investments sinking? The market is up almost 100% in the last 2 years!

Other ads try to scare you into owning gold.

First, comes the scary music, and then a low, dark, and concerned voice gives all the reasons the world is about to end. “National debt, unemployment, inflation, the housing crisis, China taking over as an economic power, all attacking your assets – and the only solution is, gold, gold and more gold”.

Gold parties, gold stores in every strip mall. Is gold the new Robitussin, good for everything? Is gold the answer to inflation, deflation, a falling stock market, a faltering bond market, and whatever else might happen?

There are plenty of legitimate reasons to own gold:

- Gold prices should rise as the value of the US dollar falls. With all the debt the US government is piling up, and the excess money the Federal Reserve has pumped into the system, you can imagine the value of the dollar falling.

- Gold can be hedge against crises in the world. The price of gold rose during the September 11th turmoil here in the U.S. and is seen as a “store of safety” by individuals and to an increasing percentage of investment professionals. It’s understandable that investors would be looking for a hedge given that we’re in the middle of our third recession and bear market since 2000.

- With gold at over $1700/ounce, it is still shy of its “inflation-adjusted high” of over $2000/ounce, reached in the early 1980s.

But there are also reasons NOT to own gold.

- You are betting on investor emotion (in this case, fear), which can change swiftly.

- Higher prices often on new mining for gold, which could result in a supply surge and price drop.

- Gold pays NO dividend, and actually costs money to store

So what’s the answer? Should you own gold, or not?

I personally think the answer is: own some gold as a hedge. First Eagle Funds added gold to their portfolios long before it was popular and continue to maintain around 10% of their holdings in gold.

But gold is not the be-all and end-all. Just because gold has gone up over the past 10 years, doesn’t mean it will always go up, as gold, like most other investments is highly cyclical. At this point, when it seems like 4 out of 5 commercials are pushing the shiny stuff, the one thing I can tell you for sure is that you’re not early to the party

Have you purchased gold lately? Either coins or a gold ETF? Are you tired of the commercials?

Gold is getting traction right now for two reasons:

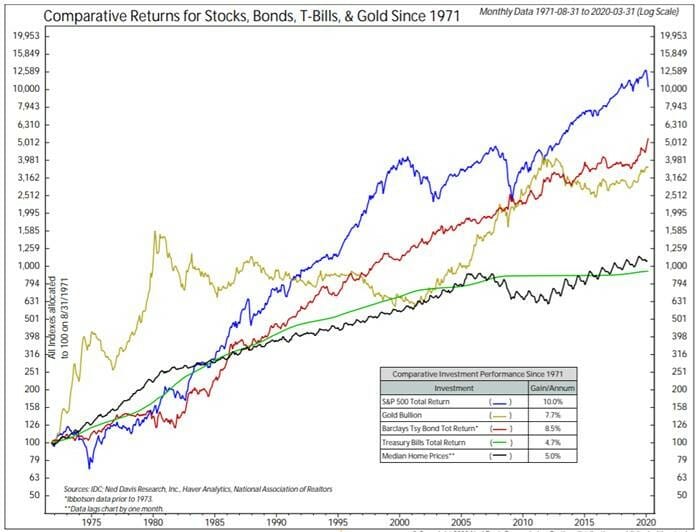

- As an inflation hedge. This sometimes works and sometimes doesn’t. Only 4 of the past 9 decades has gold kept up with inflation. The 1930s, 1970s, 2000s, and 2010s. Gold did NOT keep up with inflation in the 40s, 50s, 60s, 80s, and 1990s.

- For the first time in economic history, gold actually pays more than much of the bonds market…by simply paying nothing. Much of the bond market actually has a negative yield aka interest rate.

So I’m biased towards owning dividend-paying companies instead. But…Gold has done reasonably well over time, especially since the 1970s, and I think there remains a good case to own some gold. Perhaps around 5% to 10% of a portfolio.

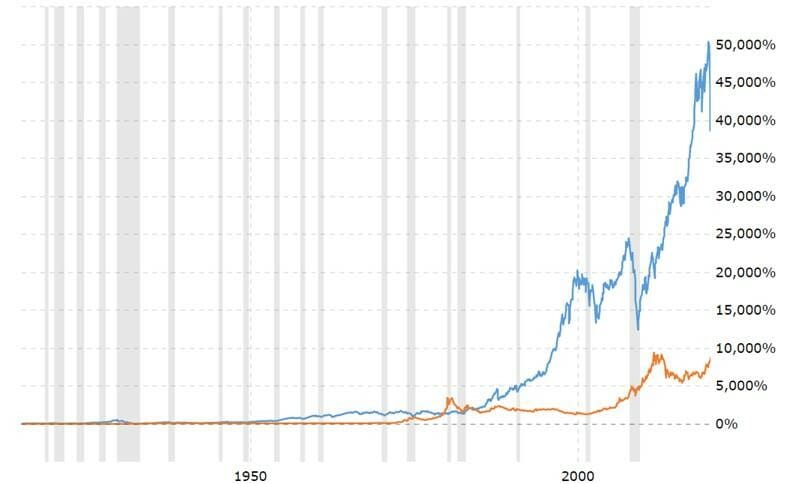

Gold vs stocks (long, long term – 1915):

Chart: LongTermTrends

Gold vs stocks (1971):

Chart data: Ned Davis Research Inc.

Wes Moss was recently quoted on Clark.com for investing in gold.

1 Comment