The idea of becoming a millionaire is alluring. For decades now, hitting that seven-figure wealth mark has been a goal shared by many Americans. Search the internet for “how to become a millionaire,” and you’ll be inundated with tips and tactics, some better than others.

But don’t go surfing just yet. Everything you need to know to begin your journey to millionaire-dom is right here.

First, know that it is entirely doable for “ordinary folk” who earn an average salary to join the ranks of millionaires. What is not so likely is achieving that status quickly or easily. The vast majority of millionaires built their wealth through hard work, investing, patience and time.

Oh, and a plan. Anyone who wants to become a millionaire needs a clear strategy for achieving that objective.

It can be daunting to think about how much you need to save if you have 10, 20, or 30 years until retirement to hit the million-dollar target. But the truth is, we often don’t need to save as much as we initially believe.

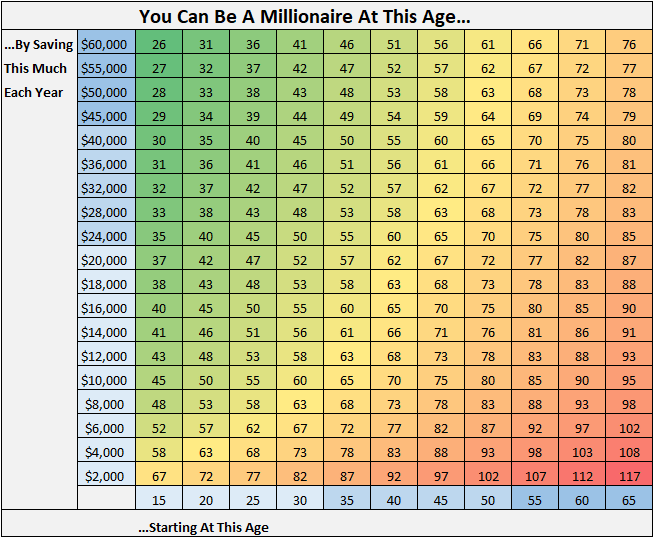

Take a look at this chart from blogger Zach at Four Pillar Freedom. It provides a simple, straightforward grid of how much you need to save annually to become a millionaire, depending on the age at which you begin saving and investing, and the year when you want to meet your goal.

The numbers in this chart assume you start with $0 saved, and that all savings are invested at a 7% annual interest rate. Note that saving in smaller increments can add up fast over the years. On the bottom of the chart is a list of ages that represent when you begin saving, and the numbers to the left-hand side correspond to how much you save each year. Where the two points meet is the age you will be once you have socked away that cool million.

For example, if you were to start saving $10,000 every year at 35, you’d have a million dollars by the time you were 65 years old, just in time for retirement. Start a decade earlier at 25 with the same savings level, and you’ll meet your goal at age 55, a full ten years before traditional retirement age.

This grid shows us that no matter when we start, by saving $10,000 a year we can become millionaires in 30 years. Up the ante to $40,000 a year, and you can be one in just half that time. And if you start young at 20 years old and save just $4,000 each year, you’ll beat traditional retirement age, too.

Now that you know you can do it let’s talk about how to make a plan and stick to it.

There’s no way around it – becoming a millionaire takes commitment to saving and investing strategically. Once you have identified the particulars of your path, you must stay the course for the long haul.

– The first step in planning your personal Operation Millionaire is to decide how much you need to save each year to reach your goal. Step two requires you to prioritize that savings/investment plan for the long-term. Need to save more money than your budget seems to allow? The answer is to look at your spending.

Savings and frugality go hand-in-hand on the way to wealth-building. The three biggest expenditures for the average American are rent, food, and transport. A Harvard University study found that 33% of American households are paying more rent than they can reasonably afford. The generally accepted rent affordability rule is that you should limit your rental costs to 30% or less of your gross income. If you can get your rent down to 20-25% of your income, that’s extra money to invest into an early retirement.

– What about food? That $200 a month you spend on lunches may not seem like much, but over the course of a year, that’s $2,4000. And over a decade? We’re talking $24,000.

– Does this invest-steadily-live-below-your-means really work? Don’t ask me, ask Warren Buffett. He’s one of the world’s wealthiest people, yet he still lives in a house he bought for $31,500 in 1958. Buffet legendarily once treated fellow billionaire Bill Gates to lunch at McDonald’s – and used coupons.

As you become more focused on long-term financial planning, you may find that you naturally spend more frugally. Thomas J. Stanley, author of The Millionaire Next Door: The Surprising Secrets of America’s Wealthy, found during his research that a fundamental principle of wealth creation for people was living below their means:

“[W]e discovered something odd. Many people who live in expensive homes and drive luxury cars do not actually have much wealth. Then we discovered something even odder: Many people who have a great deal of wealth do not even live in upscale neighborhoods.”

With a bit of determination and patience, anyone can become a millionaire. The change in mindset won’t come overnight. There are going to be a lot of variables along the way, but, if you can curb your spending and up your savings, you’ve taken the first step to retiring earlier. Use these simple methods as a fundamental guide on your journey to the millions.

Check Out: 5 Secrets To Becoming America’s Next Self-Made Millionaire

1 Comment