Considering the decades of financial and emotional investment parents make into their kids, it’s no surprise that, even in retirement, parents’ levels of happiness are dramatically shaped by their children.

The cost of raising a child today is $233,610 – excluding the cost of college – for a middle-income family, according to the latest research from the U.S. Department of Agriculture. Kids remain one of life’s biggest line items – and beyond the financial implications of raising them, parents be wise to the other, lingering ways that kids can impact the future. Thoughtfulness around how, when and where they build connections with adult kids in the years post-retirement, is critical to making the golden years actually golden.

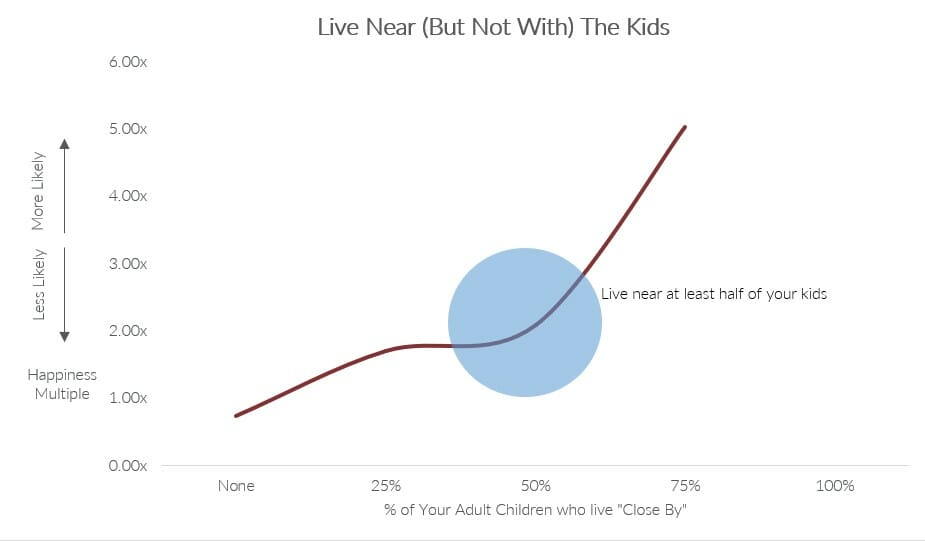

In my recent money and happiness survey of nearly 2,000 retirees nationally, one of the most profound findings had to do with retirees’ proximity to their kids. Nearness to kids is more than just a geographic data point. In some ways, it’s a simple barometer to measure the massively important relationship you have with your family and community. Of those that I surveyed, the retirees that lived “near or close” to at least half of their children were 5X more likely to be happy than those that did not. Think about this: if Jim and Kathy have three kids and live in Atlanta, they are 500% more likely to be happy if two of them live in the state. Parents and grandparents often talk about not being able to put a price tag on experiences. And there’s nothing like children and grandchildren to help build a long list of those unforgettable life memories. And for many retirees, happiness and proximity to their children is as much about the parent-child relationship as it is about being able to be good grandparents. An overwhelming amount of research is devoted to parent-child dynamics, yet, as other research shows, close grandparent-grandchild relationships are themselves a marker of strong family ties and come with their own distinctive benefits around well being.

The happiness benefit associated with nearness has its limits, however. The same surveyed retirees were found to be 2X more unhappy if their adult children still lived at home. Understandably, respondents noted similar levels of unhappiness if their adult children were not married, as marriage is often a catalyst for getting kids up and out. While you can’t control if your kids ultimately get hitched, statistics indicate an important point: unmarried adult kids or adults kids that live at home are significantly more likely to be dependent on mom and dad. This financial and emotional burden of this is just too hard for many retirees. This period of life requires tremendous adjustment: careers, relationships, financial planning – all of these are in flux. Parents may struggle with how to appropriately care for or relate to a child that is an adult, but still inside their home. They may also find themselves resenting the unexpected extension of parental responsibility in a season that was supposed to be “about them”. I’ve written in the past about the importance of moving adult kids toward independence, and while every child/retiree relationship is complex, circumstance different and financial situation varied – the data shows that taking kids off the payroll, or at least giving them a pay cut, also boosts happiness in retirement.

A related issue for retiree happiness is the level of education for kids. Huh…how does my kids’ education fit in an article on living distance to mom and dad?

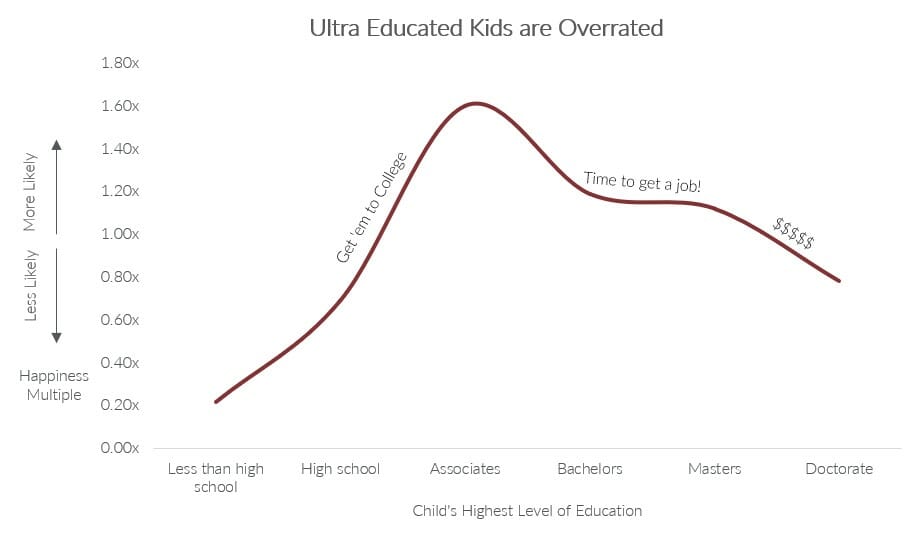

My research shows that if their kids graduated from high school only, the retiree is more likely to be unhappy. Families with college educated and beyond children saw the highest happiness levels. Interestingly, happiness levels begin to decline for retirees where their adult children received masters or doctorate degrees. Here again, the issue of proximity and dependence show up and take a toll inside the retiree’s home. Under-educated kids may stay dependent on mom and dad. Aside from parents’ guilt, disappointment or feelings of failure for not adequately preparing them, these retirees may struggle financially or otherwise by having an adult child on an extended stay.

For retirees with over-educated kids, they may have a strikingly similar experience. Perhaps the child is perpetually lacking life direction. Or maybe, they’re out of the house, but so buried in their dissertation that they don’t have time for the occasional call or dinner. Either way, the dynamic becomes a drain.

Often too, the financial cost of graduate school is picked up by a mom and dad who may feel an obligation to support (big) little Johnny’s dreams of being a Ph.D. in art philosophy. This is a hot-button issue in many of my retirement planning conversations with clients. While spouses may be split on this, if it means Johnny will have another few years under your roof, think long and hard.

No matter kids’ ages or stage of life, parenting brings incredible moments of joy and equally significant pockets of difficulty. Retirees are wise to consider everything from where they’ll set down roots to how much they’ll spend on the kids’ education to maximize everyone’s opportunity for happiness.

2 Comments