Sufficient funds may not be the only ingredient in the happy retirement sauce, but there’s a reason the recipe calls for it. Of course, you could make marinara without tomatoes, but why would you punish your taste buds that way?

There’s no way around the fact that money serves an essential purpose. It provides opportunities and flexibility. Look, I know Buddha renounced his royal palace to live as an ascetic, but most of us need more realistic goals. I know I do.

Based upon the research for my book, there are five vital money secrets that the happiest retirees on the block (HROBs) responded with importance.

Five Money Secrets

Note, that these are meant to be used as a full recipe together, rather than picking and choosing ingredients.

-

- Having at least $500,000 In Liquid Retirement Funds

- Mortgage Payoff Within Sight

- Multiple Streams of Income

- Income Investor — Saving Doesn’t Typically Cut It

- 4 Percent Plus Spending Rule — Set a goal to max It Out Without Running Out

Today, we are going to focus on number four. I put it in bold so you would pay extra attention. I hope that today’s foreshadowing will prevent tomorrow’s foreboding.

Let me explain.

It’s human nature to value our hard-earned wages and ferociously protect them like a mama bear spotting danger to her cub. The logic, then, follows that perhaps it might be a good idea to put our savings into safe, conservative money market accounts rather than investing them in a volatile stock market. I get it. I have the same urge from time to time.

The problem is that unless each paycheck is higher than most of us, including me, are making, the low-interest rate on a regular savings account won’t usually earn us enough to sustain a comfortable lifestyle in a fixed-income retirement.

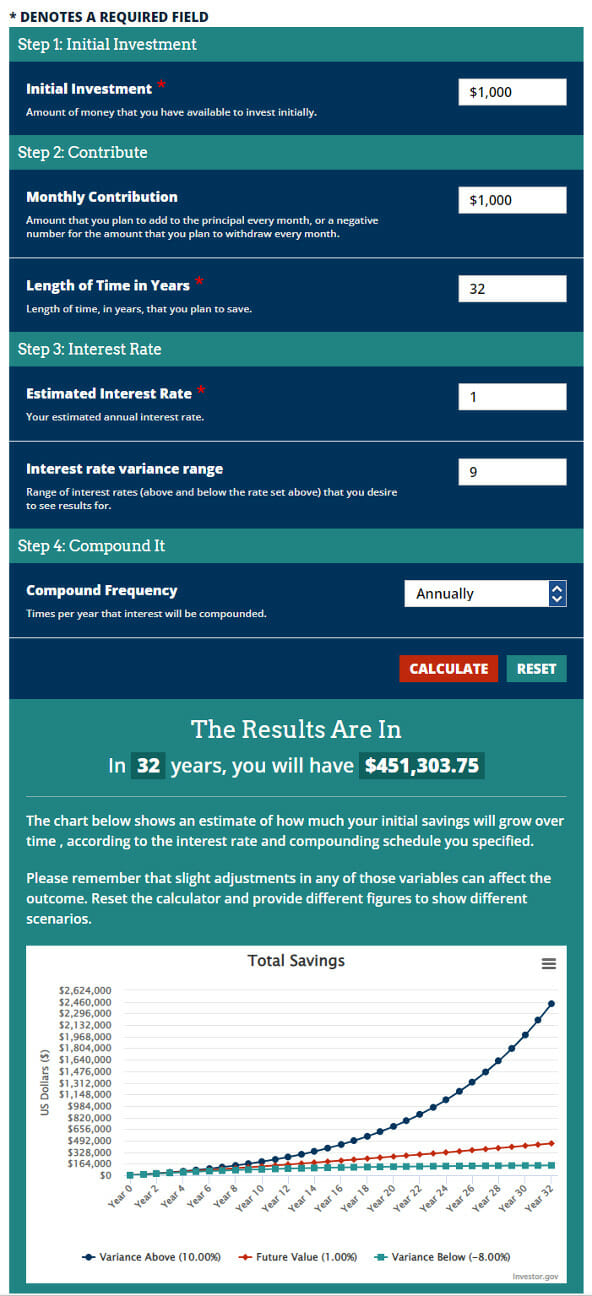

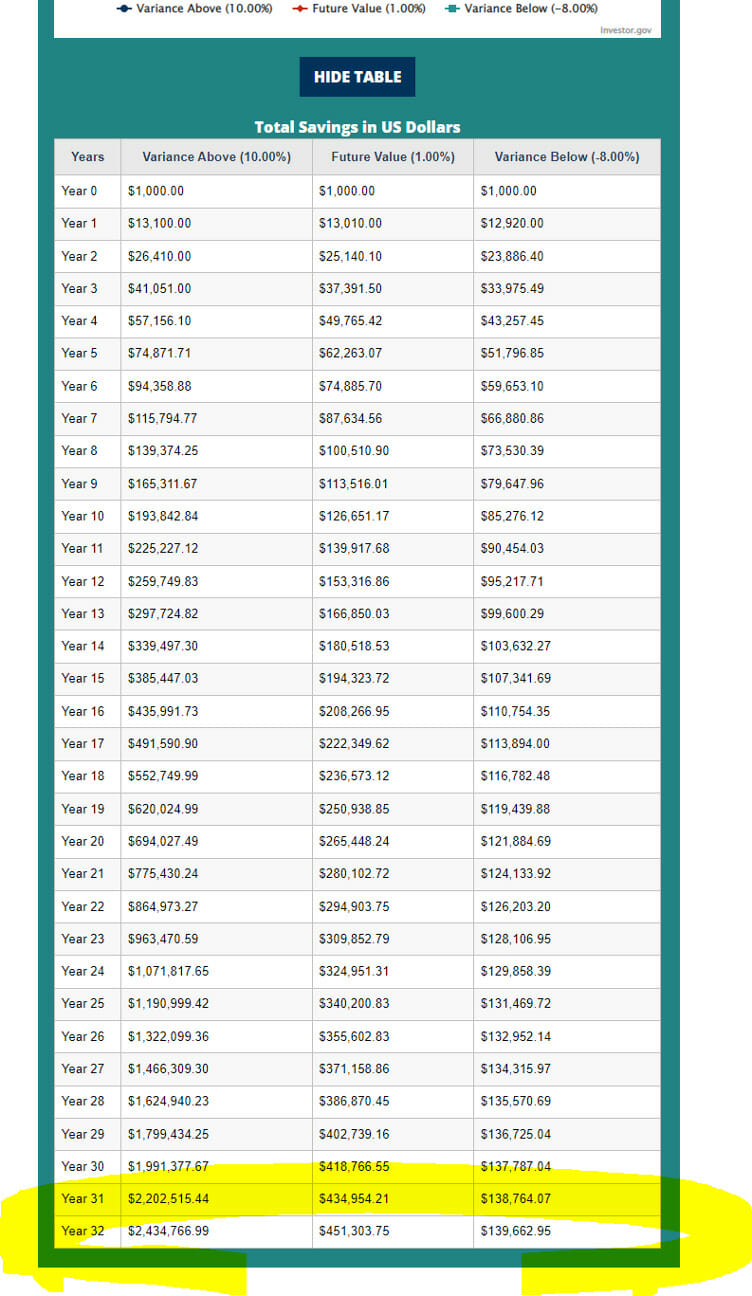

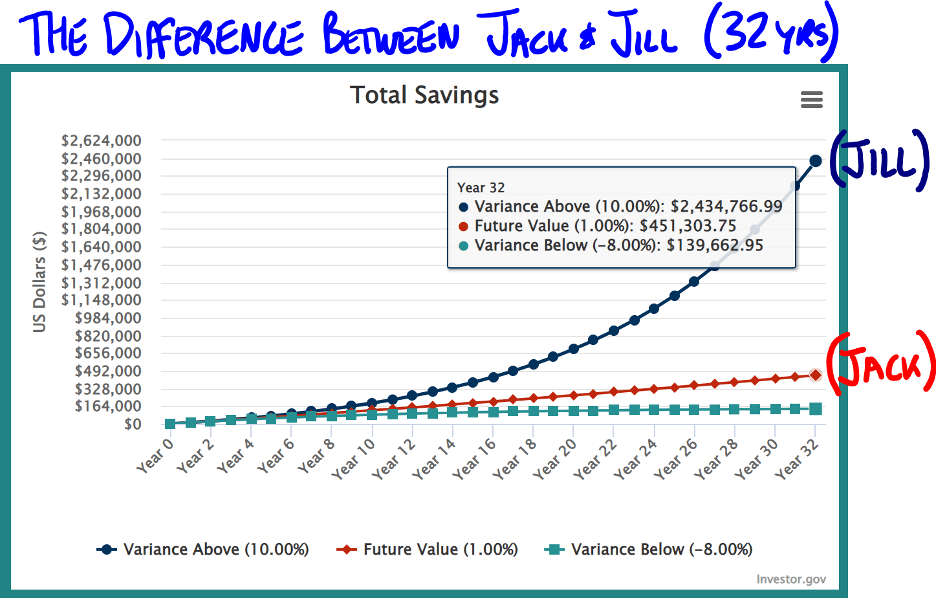

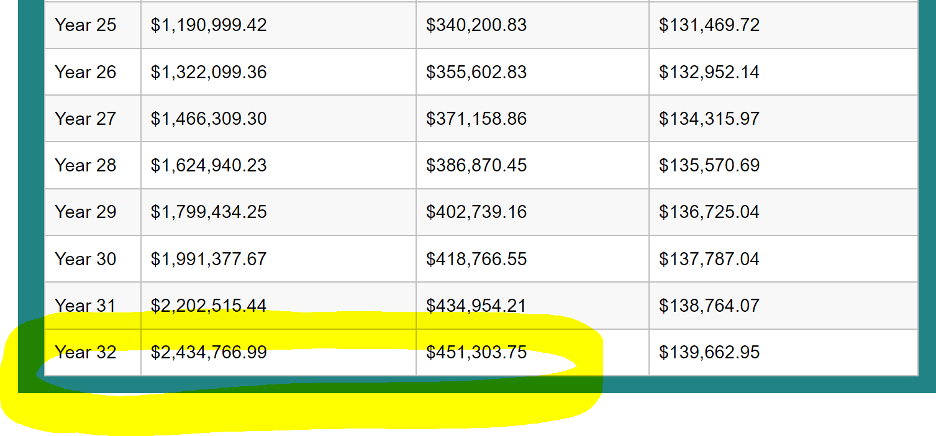

Take a look at the chart below.

Source: Investor.gov Note, both hypothetical investors start with $1,000, and add $1,000 per month for 32 years, navy blue line (Jill) compounds annually at 10%, the red line (Jack) compounds at 1% annually.

We’ll use Jack and Jill as our hypothetical test cases. Jack is a saver. Jill is an investor. Each one managed to save $1,000 per month for thirty years. Pretty good. Yeoman’s work.

Jack socked all of his money in a savings account. If he’s lucky, he’ll see a 1 percent average compounded return on his money.

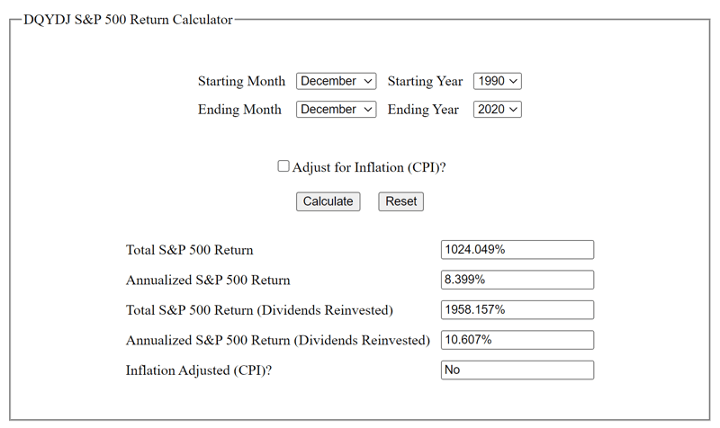

Jill was just as responsible a saver as Jack, but she made one small change. Instead of parking her earnings in a money market, she invested the same amount in a stock-based index mutual fund or exchange-traded fund (ETF). As a result, she can reasonably hope for 10 percent compounded annual returns because, in general, the S&P 500 often hovers above or below that bellwether mark. For example, the rate of return for the S&P 500 with dividends reinvested from 1990 through 2020 (thirty years) averaged 10.6 percent per year.

So, Jack the saver is looking at a 1 percent rate of return. Presupposing he endured this saving routing for 32 years, he would have ended up with slightly more than $451,000.

On the other hand, Jill the Investor enjoyed a 10 percent annual rate of return and ended up with more than $2.4 million. Quick show of hands, how many of you would rather have $2.4 million than $451,000?

Jack and Jill both worked hard, and both saved conscientiously. The divergence was where they put their money. Jack was a saver. Jill was both a saver and an investor. This one change could make a $2 million difference.

Source: https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

Note that in the above example, we referenced stocks listed on the S&P 500. Investors with a growth bias (growth investing) or a value bias (dividend investing) both have strong potential for long-term gains. Still, HROBs tend to gravitate toward income/dividend investing as they move from the accumulation phase to the distribution phase of their lives.

HROBs know that being a saver isn’t enough. They keep emergency savings, sure. That goes without saying. But most of their retirement funds are typically invested in equities for extended periods because the overarching goal is to acquire enough capital to stop working and “retire sooner.” It’s a lofty aim and challenging enough without stacking the deck against yourself by failing to take advantage of the long-term investing potential of companies here in the United States.

No one likes losing money when the market dips. But I’ve studied economic trends and seen enough consistency to feel comfortable that the army of American productivity typically bounces back when it falters. I use that knowledge and experience to remain disciplined about investing and providing for a happy life in retirement.

At Capital Investment Advisors, our financial advice focuses on retirement income planning, helping to ensure that your spending needs will be met over multiple decades, even with future inflation. Click the image below to schedule a free consultation with our team.

This information is provided to you as a resource for informational purposes only and is not to be viewed as investment advice or recommendations. Investing involves risk, including the possible loss of principal. There is no guarantee offered that investment return, yield, or performance will be achieved. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. For stocks paying dividends, dividends are not guaranteed, and can increase, decrease, or be eliminated without notice. Fixed-income securities involve interest rate, credit, inflation, and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed-income securities falls. Past performance is not indicative of future results when considering any investment vehicle. This information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. There are many aspects and criteria that must be examined and considered before investing. Investment decisions should not be made solely based on information contained in this article. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. Always consult your own legal, tax, or investment advisor before making any investment/tax/estate/financial planning considerations or decisions. The information contained in the article is strictly an opinion and it is not known whether the strategies will be successful. The views and opinions expressed are for educational purposes only as of the date of production/writing and may change without notice at any time based on numerous factors, such as market or other conditions,

Calculator Notes for reference

https://www.investor.gov/financial-tools-calculators/calculators/compound-interest-calculator

See calculator assumptions below.