A handful of tech firms have incredible influence in our daily lives. It’s true. You can Google it on your Apple iPhone or Microsoft Surface. Maybe ask your friends their opinion on Facebook. Amazon might even have a book on the topic.

Are the stocks of this same small group of companies also dictating the stock market’s performance? And if so, what should investors do about that – if anything?

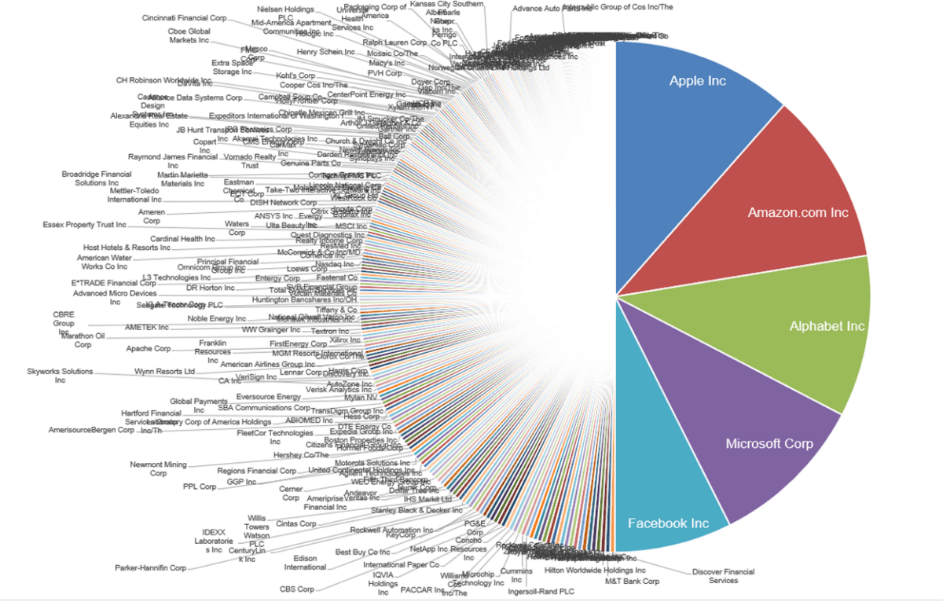

“The chart shows the relative weights of the top five companies in the S&P 500, alongside the bottom 282 on the left-hand side. The key point here is that investors in a market cap weighted S&P 500 index fund have as much exposure to just five companies as they do to the smaller 282 companies combined.” – Exponential ETFs

The top five stocks in the S&P 500 are tech companies – Apple, Alphabet (Google’s parent), Microsoft, Amazon, and Facebook. These digital giants have a combined market capitalization of $4 trillion, which is equal to the combined market cap of the bottom 282 firms in that index.

Some observers see this as evidence of a “narrow market” in which just five stocks are calling the shots. This situation, they warn, increases the risk of owning a market cap-weighted S&P 500 index fund because investors have the same amount of exposure to just five companies (the tech titan) as they have to the bottom 282 companies.

To put the concern another way, the current dominance of tech firms undermines the diversification investors seek when buying S&P index funds.

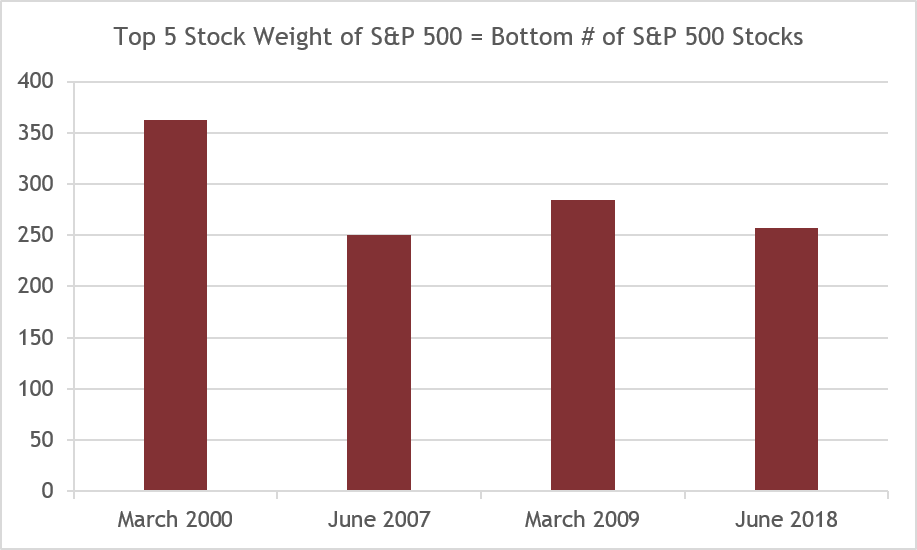

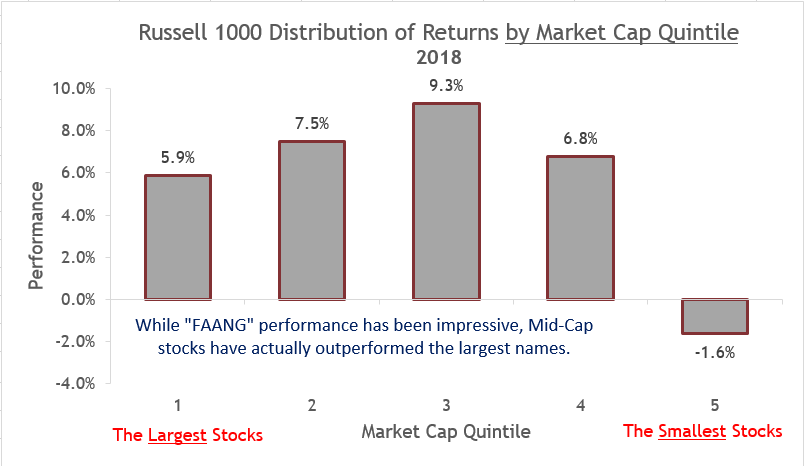

My answer to that theory: No, not really. This is not some strange new situation brought on by the rise of technology giants. Over the years, the markets have very often experienced the same type of large-cap dominance. In fact, it’s been that way for the past 18 years. But the market’s largest stocks have not been as unusually dominant as commonly reported. Looking at the Russell 1000 into market-cap quintiles (quintile 1 = largest stocks, and quintile 5 = largest stocks) actually finds that it is quintiles 2,3 and 4 that have outperformed this year.

And get this: If you were to create an Inverse S&P 500 where Apple has the lowest weight, and the smallest stock in the index has the largest weight, that inverse fund would be up almost the same amount as the normal S&P 500.

So, while there is always lots to consider and fret over as an investor, in my opinion, tech’s dominance of the S&P 500 isn’t one of those things.