Here we are, closing in on election day, November 3rd. With the run-up to the election, voters have much to think about. As folks weigh their options, one issue is quickly rising to the forefront. That issue – taxes.

Tax policy – meaning tax breaks and tax hikes – is a hot-button issue in most, if not all, presidential elections. Even Cardi B asked Joe Biden in a recent interview, “But what a lot of people are concerned about is, if the government gives us [these things], are they going to raise our taxes? Because clearly nobody wants to pay so much in taxes…” “…People want to know, can you provide college education, this [health care] plan, without a big chunk of taxes coming out of our checks?”

To which Joe Biden responded, “Yes, we can. And the way we can pay for all of this is doing practical things, like making sure that everybody has to pay their fair share.”

With the release of Joe Biden’s tax proposal, now we have data on what he is proposing, relative to the current state of US taxes. Keep in mind we are talking about Federal Taxes here, and state taxes would be in addition to our discussion below.

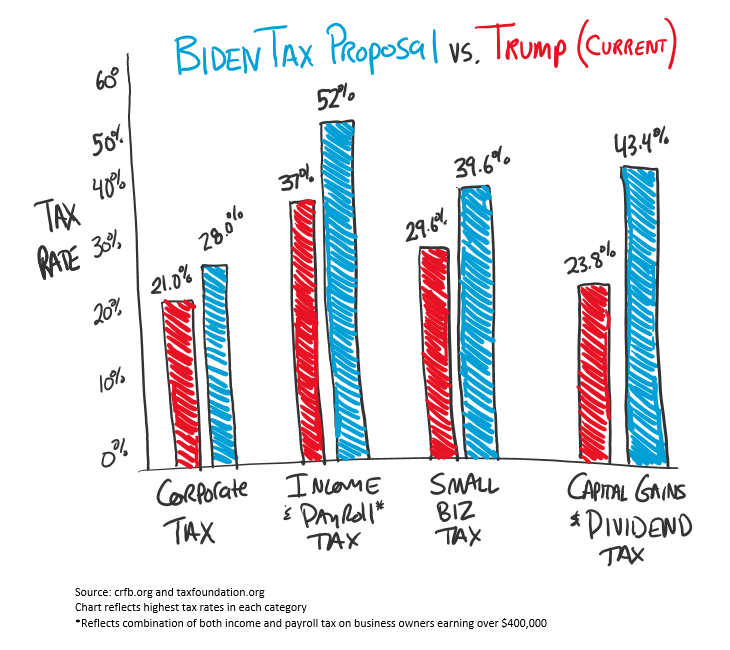

Take a look at the comparative chart:

As you can see, the proposed changes (in blue) to taxes could impact a very broad section of America. Corporate taxes, income and payroll taxes, small business taxes, and capital gains and dividend taxes don’t just impact a select few. Keep in mind the above chart reflects the highest tax bracket in each category.

Corporate Tax – This tax category affects net earnings and could impact the market as a whole. So, an increase here stands to affect most publicly traded companies, and in turn, your 401k.

Income and Payroll Tax – This one could impact everyone, but the majority of the increase would specifically hit high-earning business owners.

Not only does Joe Biden propose to increase the top bracket for income taxes from 37% to 39.6%, but it also includes a new payroll tax of 12.4%. The additional tax is on earnings above $400,000. This creates a worst-case scenario for high-earning business owners who must then cover both the employee half (6.2%) and the employer half (6.2%) of the 12.4% payroll tax pushing their total federal tax rate towards 52%.

Small Business Tax – The reason for this change would be the removal of existing small business tax deductions currently in place. This would have an impact on both the owners and employees of these small businesses (outfits with fewer than 500 employees, as defined by the Small Business Administration (SBA)).

Small businesses account for 99.9% of all US businesses, with 30.7 million of these companies in America, says the Small Business Association. These “mom-and-pops” account for almost 50% of our workforce and nearly 45% of our GDP. They’re also job creators year in and year out; in 2019, small businesses created over 60% of all new jobs, translating to roughly 1.5 million jobs annually.

Capital Gains and Dividend Taxes – Our current 23.8% rate is based on a 20% maximum capital gain rate plus the 3.8% net investment income tax imposed on families earning over $250,000.

Biden’s proposal would shift the flat rate from 20% to the highest marginal income tax bracket of 39.6%. In effect, this change would take the existing capital gains tax and changing it to your ordinary income rate. (Add this number to the 3.8% investment tax, and you get his proposed rate of 43.4%.)

In my opinion, you have to be pretty far left on the political continuum to wish for the higher tax rates shown in blue. Those who stand behind the hikes and want to vote for them must be thinking that higher taxes pave the way to more government control and improved American quality of life. This is not a sentiment that I share.

The best argument for increasing taxes is that it could help chisel away at the massive deficit and debt that we continue to build on here in the United States. But even this point of view falls flat. The most effective lever in solving a deficit crisis is through robust economic growth. And higher taxes are more likely to suppress business activity.

The only real solution to tackling our debt is to both cap our spending and put all of our efforts into growing the economy, which in turn would produce more in tax receipts. Higher growth with contained spending is the answer. Not higher taxes across the board.

Here’s an overview of some of the most important conversations surrounding tax in the US, all of which will likely gain steam and importance headed into the election.

A Payroll Tax Cut Executive Order – Trump recently signed an executive order that aims to cut payroll taxes through the rest of 2020. This cut will likely put between $1,000 and $2,500 into the pockets of American workers earning less than $104,000 on an annualized basis.

Biden’s Proposed Tax Plan – The chart above referenced the difference between current taxes and Biden’s proposed tax rates. What would the proposed tax increases actually cost taxpayers? An estimated $3.5 Trillion in new taxes over the next decade. Yes, $3.5 Trillion.

Serious Consideration to Reduce Capital Gains Taxes – Now, Trump can’t unilaterally reduce the capital gains rate (which can already be as high as 20%). But, he could direct the Department of the Treasury to change how capital gains are calculated and index the gains to inflation. If he’s successful, he could lower the capital gains tax equation and net taxpayers’ savings on a variety of taxable events.

Lower capital gains taxes mean an increase in flexibility when it’s time to use your appreciated stock assets, real estate assets and even private business assets. It can make assets more palatable to sell by reducing the tax handcuffs. Plus, lower taxes immediately increase the value of most assets in general.

Over the longer term, a capital gains tax cut can spur new business formation, give consumers more money in their pockets and increase the purchasing power of investments. Taken as a whole, this results in more gains to be taxed and more taxes collected. So, we can try to tax our way out (and stifle the economy) or grow our way out (and bolster the economy).

As Americans wrap their minds around new potential tax rates, it will be an increasingly critical part of the election conversation, and undoubtedly a polarizing one. As campaign strategist James Carville said in 1992, “It’s the economy, stupid.” And as much as things have changed in 2020, I doubt this old saw will.

3 Comments