When it comes to predicting recessions, economists are like weather forecasters – to say they don’t always get it right is an understatement. In fact, most of the time they get it wrong. That’s because, like the weather, economic conditions and their related data points change constantly. This reality makes it incredibly difficult to extrapolate the numbers and get an accurate reading of where the economy might be headed.

Think of March Madness as an example. Every fan knows the chance of picking a perfect tournament bracket is slim. It’s actually one in 9.2 quintillion, and a quintillion has a whopping 18 zeros behind it. (No wonder Warren Buffet is confident offering a million bucks a year for life to anyone who gets the perfect Sweet 16 bracket.)

The chances of accurately predicting a recession are even more remote.

With the bracket, there are two data points for each team – win or lose. The economy isn’t that simple. No data point in this realm is black and white. Instead, they are shades of grey, like backward, forward, short term, long term, strong, weak, etc. And, there are a myriad of such grey points to consider.

When you think about all of the moving parts in both the domestic and global economy, then you see the inherent difficulty of making accurate big-picture predictions.

Current numbers and historical trends can help us make relatively accurate predictions at the sector-level, such as housing. But the macro-economy is just too darn fluid to pin down for accurate, reliable predictions.

Human emotion and our propensity for bias make it even more difficult to predict a recession. For example, if you’re a Republican, you probably see the current economy as healthy and robust. Democrats, looking at the exact same data as their Republican friends, see things differently. Such bias isn’t limited to non-economists; the pros are susceptible, too.

When it comes to stocks, there seems to be an excess of doomsday prophets out there right warning that markets are about to fall, correct, or crash. But every cry of “The market is about to fall!” we’ve seen stocks do well instead. This has happened hundreds of times just in the past decade.

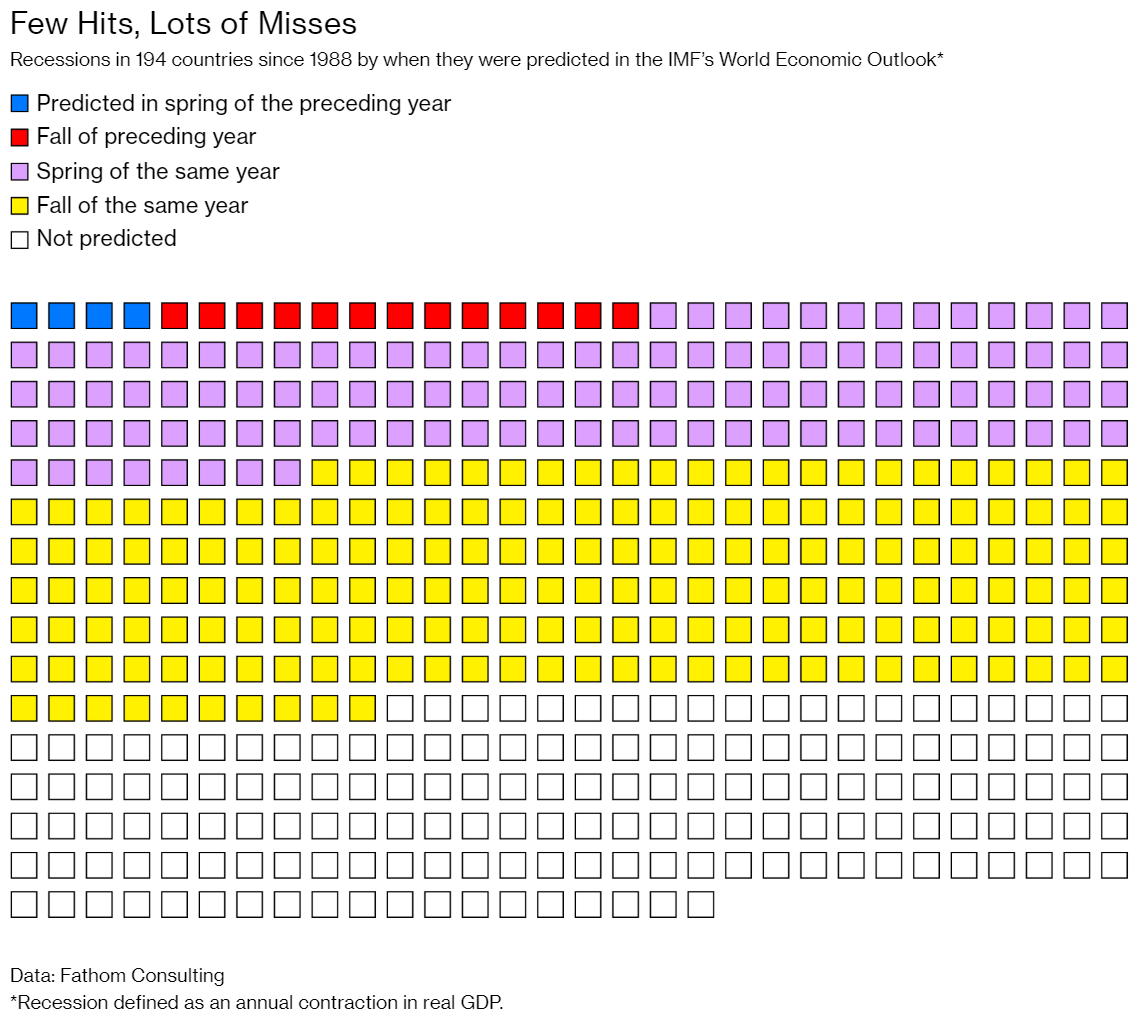

For the economy, it’s the inverse. Not surprisingly, few recessions have been well forecast. British economist Andrew Bridgen compiled data that shows that of the 469 economic downturns that have taken place since 1988 in countries throughout the world, the International Monetary Fund (IMF) had predicted only four by the spring of the preceding year.

Four out of 469. That’s a 99.15% failure rate.

Once a recession was right around the corner (in the spring of the year in which it occurred), then 111 out of 469 times the IMF got it right, bringing their average up to 24%. Bridgen also found that since 1988 the IMF has “never forecasted a developed economy recession with a lead of anything more than a few months.” Things that make you go “Hmmm.”

Recessions in 194 countries since 1988 by when they were predicted in the IMF’s World Economic Outlook*

So, you see why we get so many predictions that say, “We’ll see an economic contraction in the next 18 to 24 months. Well, yeah, it’s the stretch game. Predicting a contraction 18 to 24 months in the future is a reasonable wager. Since 1959, the chance that the US economy will be in a recession in any given month has been about 13%, according to the Federal Reserve Bank of Philadelphia.

If a recession is inevitable – if not imminent – how should you prepare? I have three suggestions.

First, recognize that it’s nearly impossible to dance between every raindrop. As an investor, you are going to have to invest in both good and bad economies and good and bad stock markets.

Second, be mindful of your economy. You don’t want to ignore the whiff of recession and make a business deal that’s ultra-risky right before a downturn. So, it’s important to understand how the economy is impacting you and your livelihood. You want to keep abreast of how economics are changing for your particular profession and how those changes might impact your earnings at work. This is one of the most overlooked pieces when it comes to financial and investment planning.

Finally, stay the course. Markets will sometimes be wonderful, and they will sometimes be awful. Accepting this reality makes the economic rollercoaster easier to ride.