Watching the ebb and flow of specific stocks can be fascinating. Peering up close at specific companies and sectors can provide investors with the real-world examples of value and opportunity that keep us all hanging around the market.

I want to zoom in on a potentially undervalued area that may be due for some economic love; an entire sector that’s fallen well below where it normally trades. Energy.

As a general rule, it’s incredibly rare for there to be a time when all stocks are in the same valuation boat, whether it be overvalued or undervalued.

Even in 1999 when the overall stock market traded at more than 30 times earnings, there were companies and sectors that were not part of the inflated tech-driven upswing. Similarly, from February of 2000 to August of 2001, the NASDAQ- 100 Index Tracking (also known as the QQQ) dropped 57%, while Energy Select Sector SPDR ETF (or XLE) was up 9%.

(As a reminder, the XLE is an ETF that is comprised of 31 holdings in businesses ranging from the big, integrated oil companies themselves to oil service providers to outfits that specialize in drilling or refining. You can probably guess some of the names on this roster – Exxon Chevron, Schlumberger, Conoco Philips, EOG Resources, Occidental Petroleum, Valero and Anadarko.)

So, instead of ballooning up or down together, various sectors and businesses respond differently to current economic trends. But there is a different kind of relationship between oil prices and oil stock prices.

I don’t like to use words like “always” and “never” when it comes to the market, as the economy is rarely so black and white. But I feel confident saying there are almost always sectors experiencing bubble-like valuations even as others are being unfairly discounted.

Take, for example, Master Limited Partnerships (MLPs). These investment vehicles, which pay investors distributions from revenue generated from the storage and transportation of oil and natural gas, have done an economic about-face – they’ve cleaned up their balance sheets and improved their businesses. But MLPs are still getting shunned by the market.

The same is true for the energy sector as a whole.

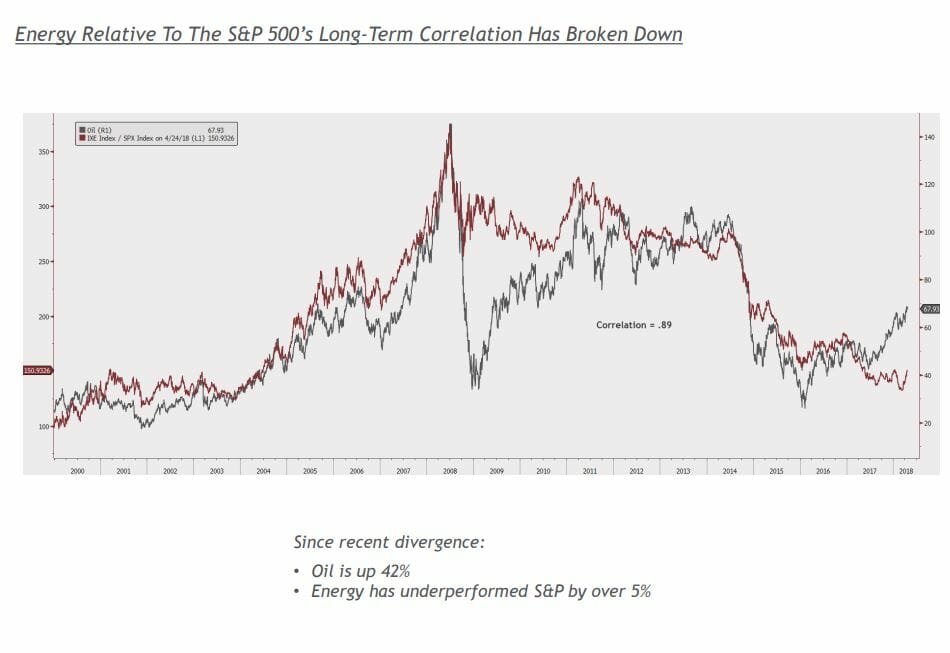

If we look back over the past two decades and chart the price of oil and the price of the Energy Index (meaning the stocks that make up the index) against the S&P 500, we see an almost 90% correlation. Looking at the chart, we see that these two charted lines track each other very closely.

We aren’t following specific prices, but rather the movement trends. When the price of a barrel of oil (WTI) rises, you see that energy-related shares relative to the rest of the market rise along with it. And when the price of oil drops, so too do the prices of energy shares in almost perfect unison.

Notice that in places where oil prices and oil stock prices diverge, they quickly come back together again. As a further example of this relationship, in the years 2008, 2013 and 2014, the price of oil and the price of oil stocks deviated. What happened next? In every case, the prices eventually converged again; either the price of oil moved down to meet stocks, or the price of oil stocks moved up to match oil. They have behaved like they were tethered together with a rubber band – one moves one way, the other moves differently, and, eventually, they snap back together.

It makes sense that increased oil prices lead to outsized profits and often result in outsized earnings. Hence when oil companies are in periods of outperformance (or underperformance), the price of oil and price of related oil stocks typically move hand-in-hand. When they aren’t acting in unison, they eventually come back to a place of relative equilibrium.

Looking back over the past 18 years, beginning in 2000 and going until about 2008, oil prices and energy sector companies’ relative performance were in near perfect balance. Late in 2008, however, oil cratered out, falling from $145 to just $35, approximately. That’s a 76% drop. As for the oil company index, it took a spill too, going from $375 to $280. This slippage was much less dramatic, representing only a 25% slip.

What’s interesting is what happened over the next year. While the oil company index stayed roughly the same relative to the market, oil prices swiftly moved higher – they rose 156% and closed the gap.

Now, this is an extreme case, but it happened, and it continues to happen. In 2013, oil prices rose about 20%, while stocks remained relatively flat. Once again, something had to give. This time, however, oil stocks stayed flat and crude oil prices came back down to earth by over 10% to meet the stocks. And in 2014, oil prices got ahead of oil company prices, falling 7% as the oil companies outperformed the market by almost 6%. Got a guess of what eventually happened? That’s right; the two ultimately converged again.

Which brings us to today. We’ve seen from our data that when crude oil prices and oil stocks price performance diverge, something usually gives way and they reconvene. Today, we see an extreme divergence between the two.

Since mid-2017 the price of crude oil has been on a tear, moving higher and higher. It’s escalated from around $43 for crude oil (WTI) per barrel to about $68 – a 58% move. At the same time, the energy sector has underperformed the market when energy stocks should be trucking right along in this environment.

What does this disparity mean? My best guess is that either energy prices are way too high and have to come back down to earth, or energy companies have to play catch up and start outpacing the S&P 500. That is, of course, if the relationship continues between the price of oil and oil companies.

As Warren Buffett noted, “If past history was all that is needed to play the game of money, the richest people would be librarians.” Still, there is real value to understanding how the economy has played out time and time again. Although I don’t think it’s likely to happen, I can see the argument that the correlation we outlined could break, just like anything else in the stock market world.

In my book, the energy sector looks to be the cheapest it’s been in a very long time. Meanwhile, the economy is good, and oil demand is still strong despite the continued rise of electric cars. If you ask me, our mainstay of energy stocks shouldn’t be written off as obsolete just yet.