I’ve said it before, and I’ll repeat it now: The third year of presidencies is when our Commanders-in-Chief really start plowing a path towards reelection. The numbers show that the US’s economic performance during the third year of a President’s term is crucial. It matters when it comes to the chief executive’s prospects for a second stay in the White House.

Because of this reality, presidents have their sights set on getting the economy into good (or better) shape during their critical third year. They know that voters like to cast their ballots for someone who can keep America’s economic engine running strong.

President Trump is no different than his predecessors. There’s been a noticeable shift that shows Trump is refocused on getting the US into better shape economically. And, the torpid war over trade has morphed from fighting it out for “a perfect deal” to working towards de-escalation, and, hopefully, an amenable resolution.

All of this is good news for investors.

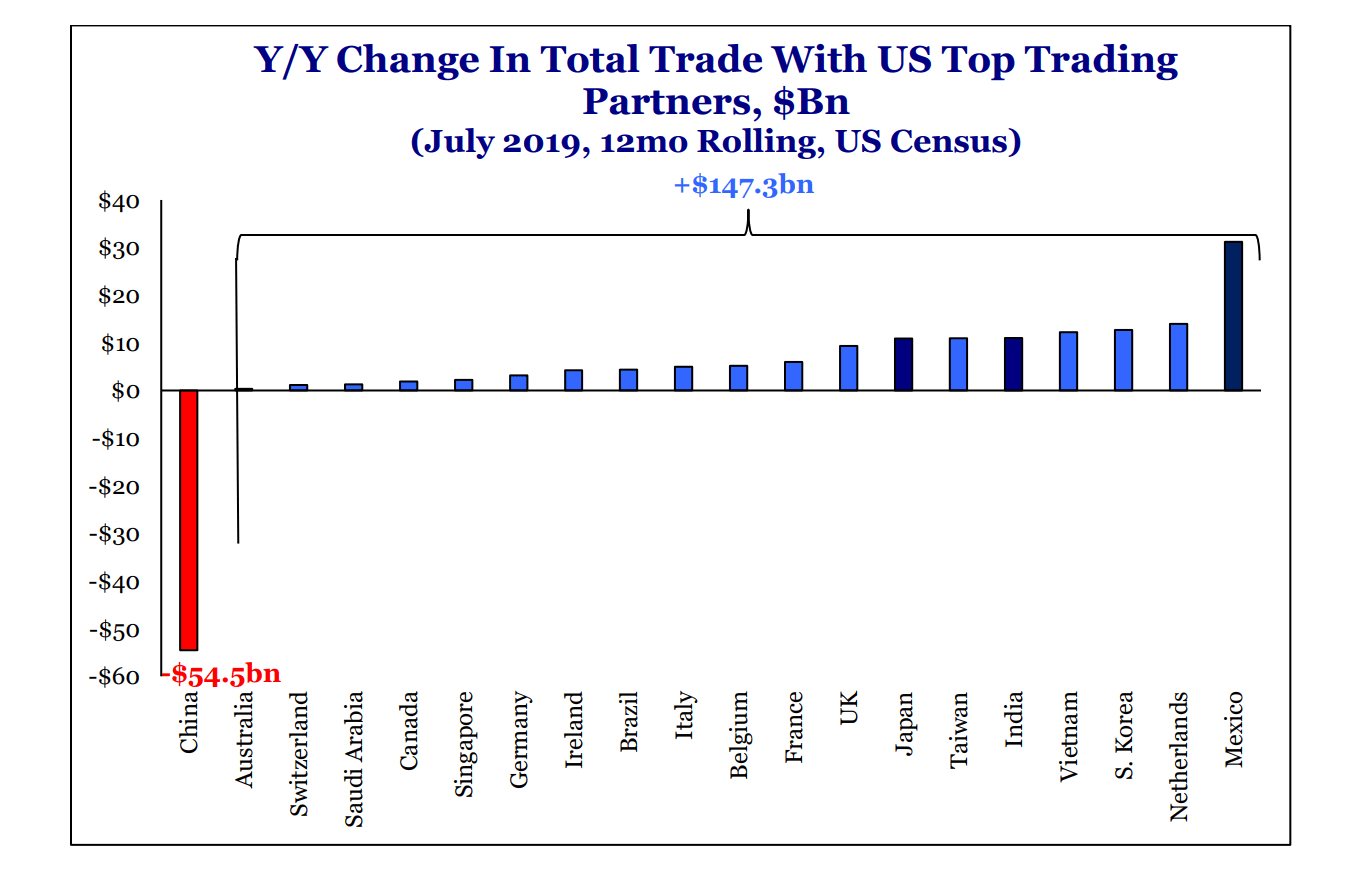

Let’s start with trade. Take a look at the chart below on how trade has changed over the last 12 months. We’ve dropped $54 billion worth of trade with China in the previous 12 months. In its place is a massive increase in trade with Japan, Taiwan, Vietnam, South Korea, the Netherlands, and Mexico – to the tune of almost $150 billion.

Chart from Strategas.

Whenever there’s a dramatic shift in trade policy like this, you can bet the economic data are the drivers. It’s not the hawks on national security that are running the show, but rather the numbers.

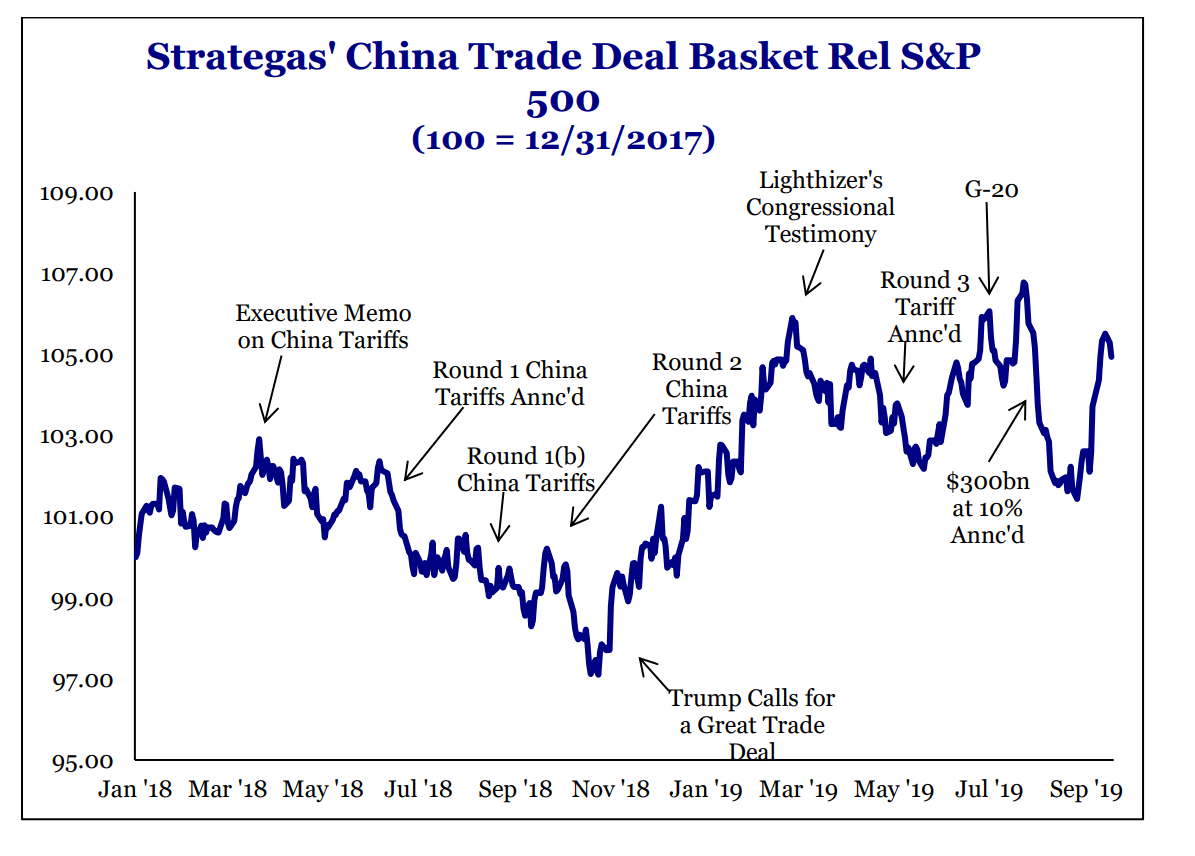

This graphic from Strategas shows the China trade war developments relative to the S&P 500 since January of 2018:

Look at the latter part of the chart – as of this month, the S&P 500 has been on the rise. That’s since August’s trade clash and the recent “cooling off period” we’re currently experiencing on that front.

Trade disputes have become more amicable across the globe. The US and Japan, for instance, have announced that they have a framework for a pending trade deal.

So far, there’s been a pause on auto tariffs. Japan has also removed most of its tariffs on our beef and pork exports – which spells great news for US farmers. There have also been lower tariffs on wine (similar to the old Trans-Pacific Partnership (TPP)). And, we’re inching closer to a digital trade agreement which seems closely aligned with provisions in the new U.S.-Mexico-Canada Agreement (USMCA).

And, the situation with China seems to have receded to a low boil. In the wake of this new trade scheme with Japan, Taiwan, Vietnam and the like, China is left clinging onto a 6% GDP growth level – the lowest it’s had in 30 years. And, I wouldn’t be surprised to see it break below that level.

Even with the Chinese economy hurting, their government seems unable (or unwilling) to rollover entirely on their regulations and business practices. But it does appear both heavyweights have inflicted enough pain by now to slow the punches.

There has been a noticeable priority shift away from global trade fights and back towards the American economy. This refocusing is no doubt due to critical information that Trump has regarding an economic change on the home front. Specifically, jobs in crucial election swing states are suffering.

The Percentage Change in Employment is falling in those states with 10% or less margin in the 2016 election. States like Pennsylvania, Wisconsin and Michigan matter a lot in the run-up to 2020.

These states have a combined total of 46 electoral votes. That’s a hefty enough portion of the US’s 538 total electoral votes that Trump would and will take notice of what’s happening there. And what’s happening is that employment is contracting.

Right now, employment is shrinking in these swing states to the tune of -1% to -2%. These numbers may not sound like much, but compare them to the 0.4% to 1.5% growth we see in states like Texas, Florida, and Georgia. Now we have a clearer picture.

It’s these industrial states that are suffering that need attention. They rely heavily on trade. And while the trade war rages on, they’re getting squeezed. These heavy-manufacturing regions are at the epicenter of the US-China fight.

No president wants the country to fall into a recession. This point is especially true with the upcoming election. So, even a whiff of a recession or downturn will move Trump to proactive measures to make the economy more stable and, hopefully, more robust.

It appears that now Trump is partnering more heavily with Larry Kudlow, his primary economic counsel. Kudlow has made a name for himself as the king of economic stimuli. He’s the man behind the curtain on the recent US economic stimulus, the framework for a trade deal between the US and Japan, the USMCA and indexing of capital gains. This teamwork is meant to keep us from falling into a downturn.

For historical perspective, since the Civil War, only one president has won reelection with a recession occurring in the final two calendar years of his first term. That was in 1900, and the president was William McKinley. Since that anomalous victory, all four presidents running for reelection with a late-term recession lost, including William Taft, Herbert Hoover, Jimmy Carter, and George H.W. Bush.

President Trump knows there’s a strong correlation between the economy and his reelection hopes. A strong economy is a powerful campaign tool. And, all presidents like to get re-elected. While the “R-word” always matters, it carries significant weight at the polls.

Here’s our bottom line. Both the US and China are beginning to see the light – that an agreement may be the best interest of everyone involved. And, the market likes it; we’re up almost 5% since the White House, under Trump’s direction, has brought the economy back into focus.

That’s how elections have been won historically. And, no matter the 2020 outcome, the US (and American investors) stand only to benefit from Trump’s recommitted focus on economic stability and growth.