Everyone wants to know: Where does the US economy stand, and what’s next? How will our financial future be impacted by the reopening of the federal government, continued trade talks with China, and the Federal Reserve’s decision not to raise interest rates?

Bottom line, the market could go either way as a result of these developments. We are in a period of economic teetering – on the fence between real growth and a backslide. Let’s look at what must go right for markets to prosper in 2019.

The Reopening of The US Government

After a 35-day shutdown, the government reopened with the passing of a short-term funding bill. This is certainly positive news, both for Americans and for markets. To me, this resolution came about, in part, because President Trump is in the third year of his presidency. First-term Presidents are already vying for reelection in the second half of their terms, making them more aware of the election impact of their actions. If all goes well, we won’t enter another shutdown, and the short-term bill will be replaced by longer funding legislation.

A Fed Pause

The folks at the Federal Reserve have already backed off on interest rate hikes, with Chairman Jerome Powell stating that a “wait-and-see policy is warranted,” as “the case for raising rates has weakened,” and “crosscurrents will be with us for a while.” Powell pointed out that “the US economy is in a good place,” and suggested that inflation is still in check. Overall, the marketplace expects the Fed to be cautious and judicious about raising rates in 2019.

A US/China Trade Deal?

This process is frustrating to watch. It seems that, on and off, Mnuchin says one thing, then Lighthizer says another, then Kudlow something else, then Trump another, then the Chinese press something different. It all feels silly at best and disingenuous at worst, but, with such a spotlight on this issue, I can’t imagine the White House not reaching some resolution on the trade war this year.

A Chinese Economic Stimulus to Offset Their Bank Pullback

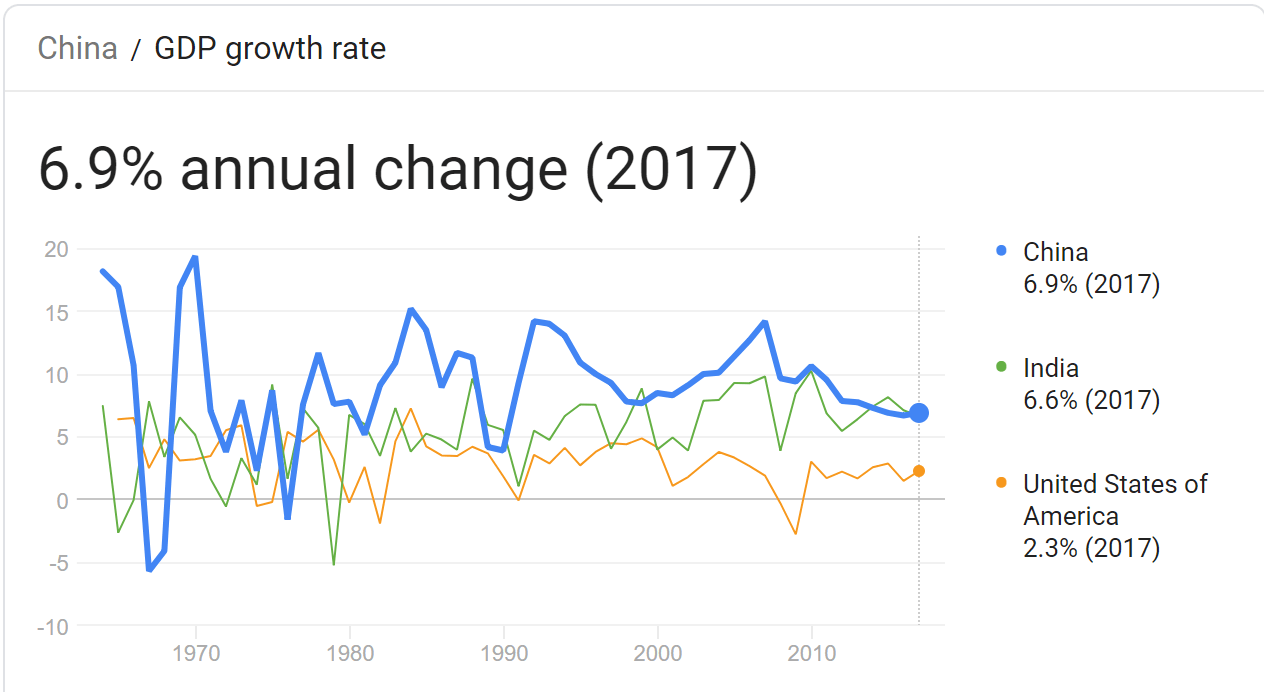

We want – and need – China to keep growing. Unfortunately, the Chinese economy has already slowed from the 7% to 8% GDP growth days.

The Chinese economy advanced 6.4% year-on-year in the December quarter of 2018, after a 6.5% growth in the previous quarter and similar market expectations. These data points marked the lowest growth rate since the global financial crisis. And, with the intense trade dispute with the US, a weakened domestic demand, and alarming off-balance-sheet borrowings by local governments, we can see what led to the downdraft. The Chinese economy expanded 6.6% – in 2018 the weakest pace since 1990.

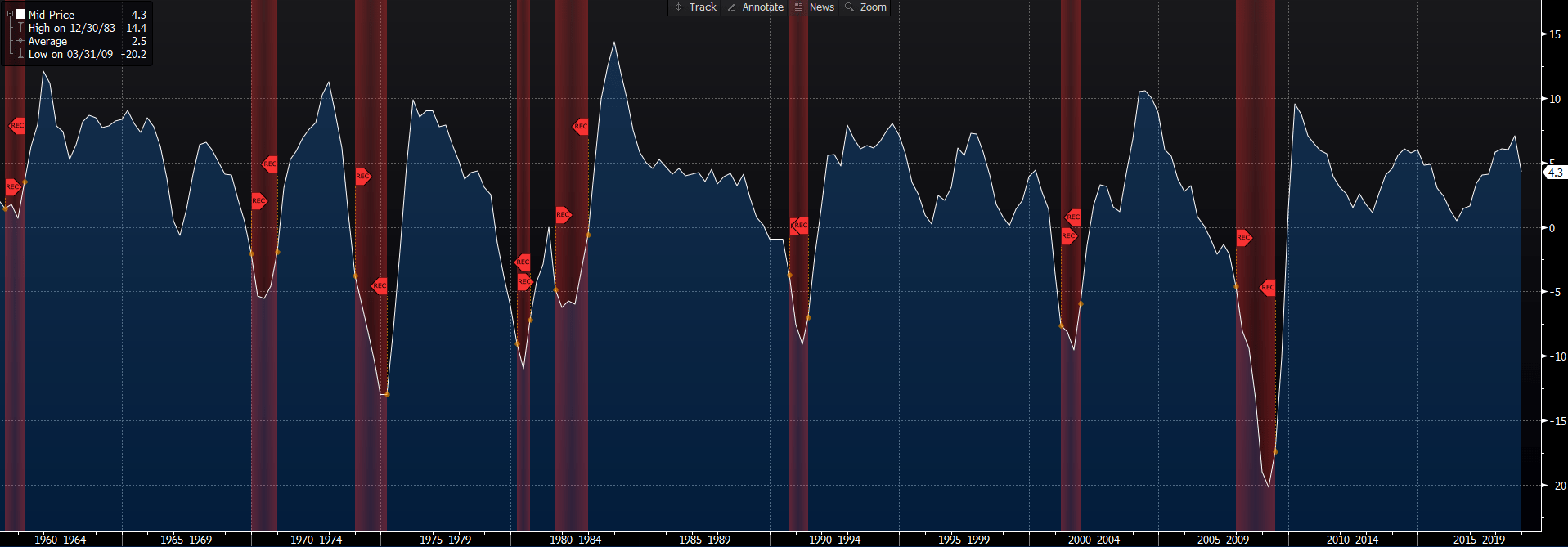

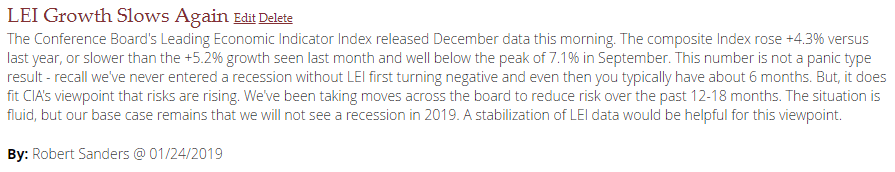

Leading Economic Indicators (LEI) Growth Slowing, But Still Well Above Zero

There’s Still Time

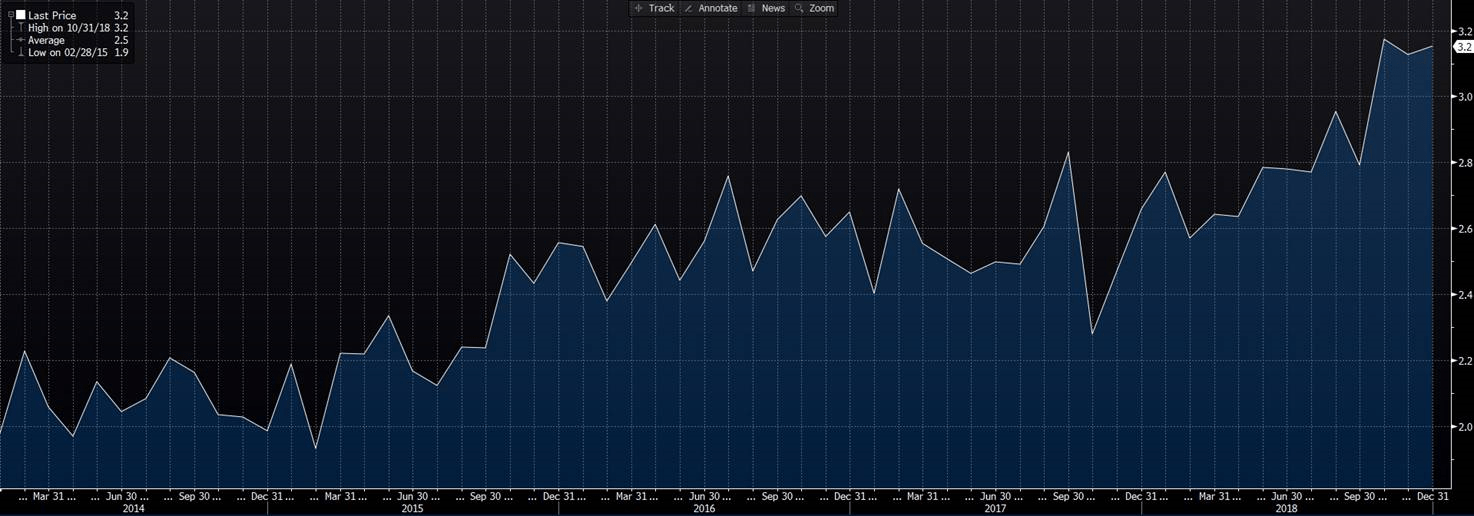

The yield spread has still not inverted, which would be a strong warning sign of recession. It’s close, at 15, but still not inverted.

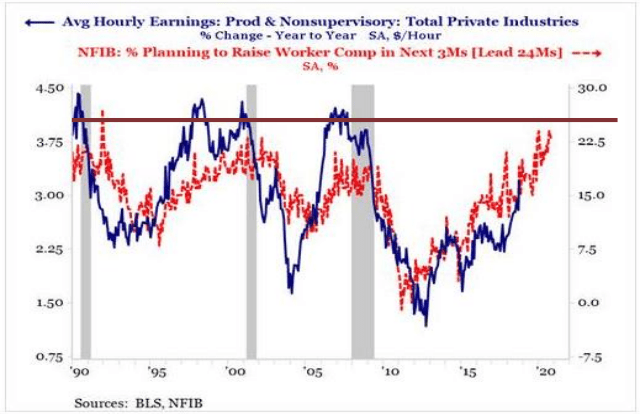

Wages

Currently, paychecks are on the rise. This development is good news to a point – while workers get more money, corporations make less. So, this positive point runs the risk of turning negative. Right now, we’re at a safe 3.2%, with the 4% mark historically being the “danger zone.”

The Bottom Line

While there are a handful of things that have to “go right” to have a great economic year, we’re still in a good place. Even without all of these elements “teetering” in the right direction, a supportive economy will serve as a tailwind. And right now, the three most important economic indicators that forewarn a recession – Yield Curve, Wage Inflation, and LEI – are all in solid (or decent) shape.

These points, of course, don’t mean that everything is sunshine and roses. But it does support the most important underlying trends for this economy, and these, in turn, are supportive of stock market growth. At least, so far in 2019.