Investing is both a science and an art. There is no one perfect way to invest. Still, over time, two major approaches to growing a retirement nest egg have emerged: growth investing and value investing.

Value investing has taken its share of criticism over the years, but I don’t think we should hang up this powerful strategy just yet.

As a refresher, growth investors attempt to find companies that are “all-in” on growth and expansion and capturing market share. These companies will have high growth rates and will direct all or most of their profits back into the company to catalyze even more growth.

Investors typically “pay more” for these businesses, meaning at a higher multiple of earnings relative to the general market. Say, for instance, that at a certain point in time the S&P 500 is trading at 17 times earnings. A company in the growth category might trade at 20, 30, 40 or more times earnings.

Value investors, on the other hand, seek companies that have a stock price that is trading below their intrinsic value – essentially “cheap” relative to what they are earning. These companies may be very profitable and have attractive cash flow, but they’re not growing at a massive clip.

These companies may grow 3% to 5% a year – or even 10% per year. But compare these numbers to a growth company that has a 20% or 50% growth target per year, and you see why they are “cheap.” And as you would expect, Price-Earnings Ratios (P/Es) here are below the market, floating in the 10x to 15x realm.

According to J. P. Morgan’s calculations, the Large Cap Growth Fund currently trades at 21x earnings, while the Large Cap Value Fund trades at 14x. For perspective, the market as a whole trades in between those two, at around 17x. The rub here is that growth has outperformed value for several years now.

Note:

TOP Russell 100 Growth: Apple, Amazon, Google, MSFT, FB, Visa, UNH, HD, Mastercard

TOP Russell 1000 Value: JPM, BRKA, XOM, JNJ, BoA, WF, PFE, AT&T, VZ

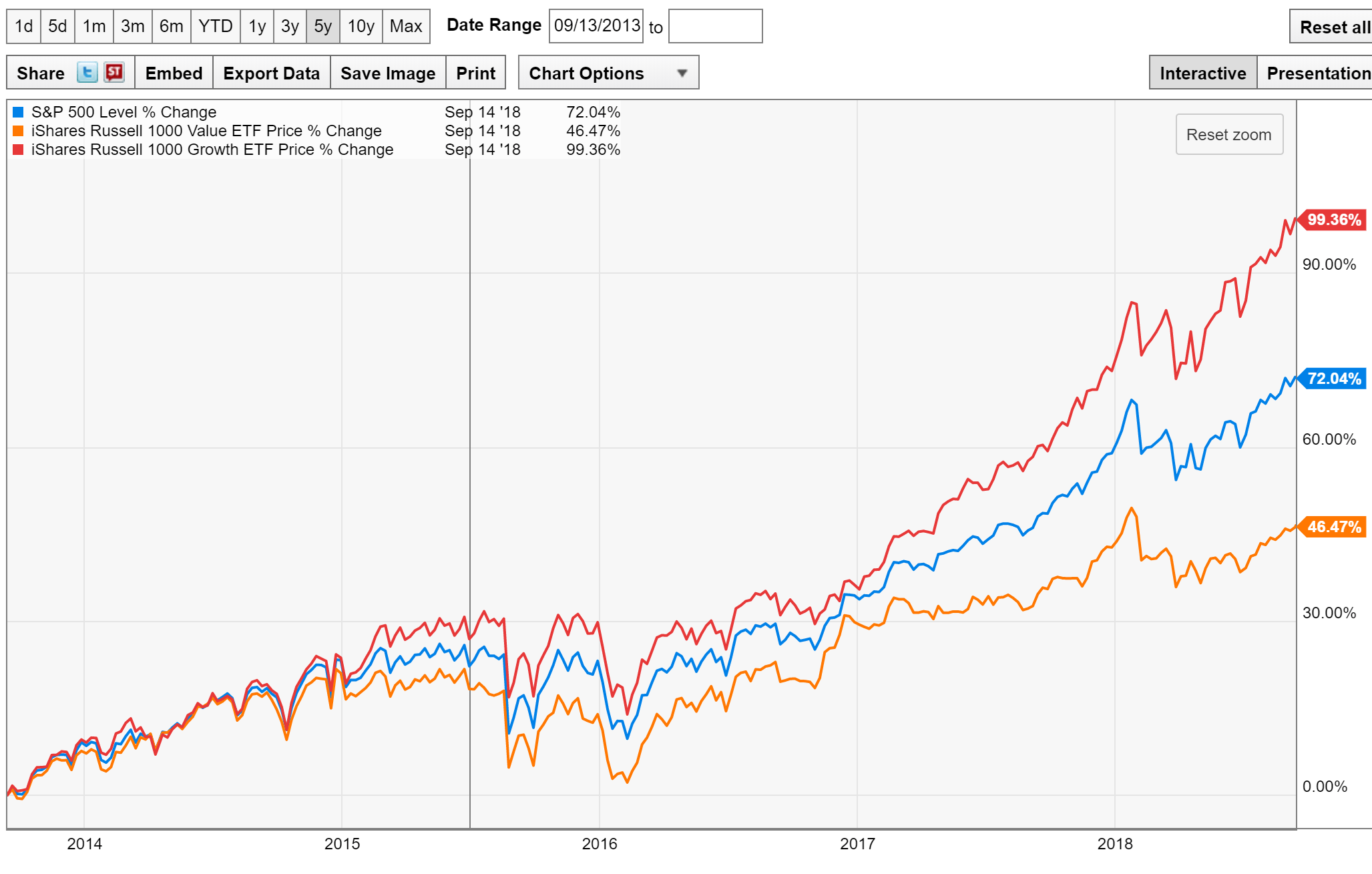

Take a look at this chart, which shows the iShares Russel 1000 Value (IWD) (in orange) compared to the S&P 500 (in blue) and the iShares Russell 1000 Growth ETF (IWF) (in red). Clearly, growth has been winning for the past five years, over which time we’ve seen +99% Growth, +72% for the S&P 500, and +46% for Value (not including dividends, which makes this number less extreme).

Source: Bloomberg Finance

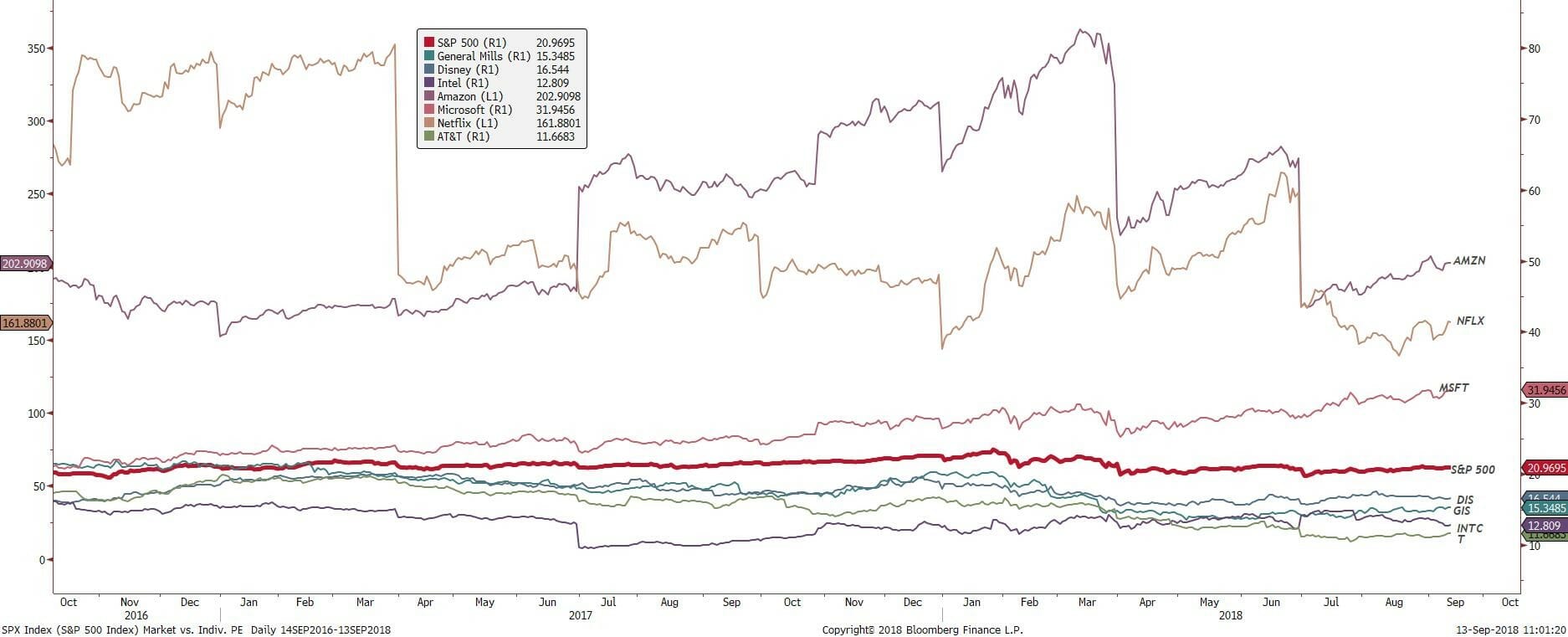

From this graph, you get a picture of the different P/Es (not market returns). As you can see, Microsoft (MSFT), Netflix (NFLX) and Amazon (AMZN) all trade well above the S&P500 (the red line). Below the red line with lower P/Es lie the value companies, such as Walt Disney Co (DIS), General Mills, Intel (INTC), and AT&T.

So, for the growth companies, if we look at forward earnings, we see AMZN is at 75x, MSFT is at 26x, and NFLX is at 118x. For the value companies, the numbers are much different. General Mills is at 15.5x, INTC is at 11x, DIS is at 14.8x, AT&T is at 9.3x, and UPS at 16.4x.

I know what you’re thinking. Will value investing ever win again? From the charts, it seems like a cut-and-dry case for growth investing. But stay with me.

Over the course of market history, the effectiveness of these two philosophies has ebbed and flowed. So, while this has been a long run for growth, that’s part of the long-term flow. At some point, there will be a reversion to the mean. Unless “it’s different this time,” a fraught phrase for investors that never quite seems to come to fruition.

Personally, I don’t believe it’s different this time. I think that, at some point, we will likely see an equalization and value with catch up. And I have my reasons.

We have been in an artificially low-interest rate environment since the financial crisis of 2009. These rates have allowed companies – even not-so-great companies – to over-borrow at insanely low costs. This practice has arguably allowed low- and no-earners to borrow and grow, borrow and grow, without ever really making a profit.

As a case in point, research shows that 35% of the companies in the Russell 2000 have not earned a profit in the past 12 months – a level that normally only occurs in the midst of a recession. Yet few of these companies have been severely punished, making it difficult for value stock pickers to get paid for separating the wheat from the chaff. Instead, the chaff, or the dregs of profitability, have still been rewarded.

Put simply, artificially low-interest rates have allowed growth investing (which, remember, is less concerned about profits) to continue to outpace its value cousin. Although no one knows for sure, I don’t think this trend will last forever. Instead, I can see an ebbing of growth and a flow for value. As we said in the beginning, there is no one perfect way to invest. This has been true for decades and decades. I don’t see this truism changing anytime soon.