Where are you on your journey of wealth building? Are you just starting, or are you well down the road to a “rich” retirement? No doubt how far along you are, you’re probably curious as to how you rank among other people.

Maybe your goal is to join the millionaires’ club. Or, perhaps you’re already there and still growing your money. Either way, it’s always interesting to see where you stand when it comes to net worth.

The problem is that wealth is tricky to define. Hitting seven figures used to be a sign of mega-success. But, because of the inflation we experienced in the 1970s and 80s, the purchasing power of money has changed.

And think about this: Being a millionaire is a broad spectrum. You could have $1 million on the dot stashed away, or you could have just shy of $1 billion. In both cases, you’re a millionaire. Not so precise, huh?

This spectrum also exists on the billionaire scale – there’s probably a big difference from your “average billionaire” and Jeff Bezos, although this point is arguably less relevant for we everyday Americans.

But, perhaps most striking is that there’s no way to talk about where most of us live – in the thousands or hundreds of thousands of net worth. (I mean, the words “Thousandaire” and “Hundred Thousandaire” don’t even exist!)

So, our language does need some clarification and better precision when it comes to describing wealth.

Or, we could just use math.

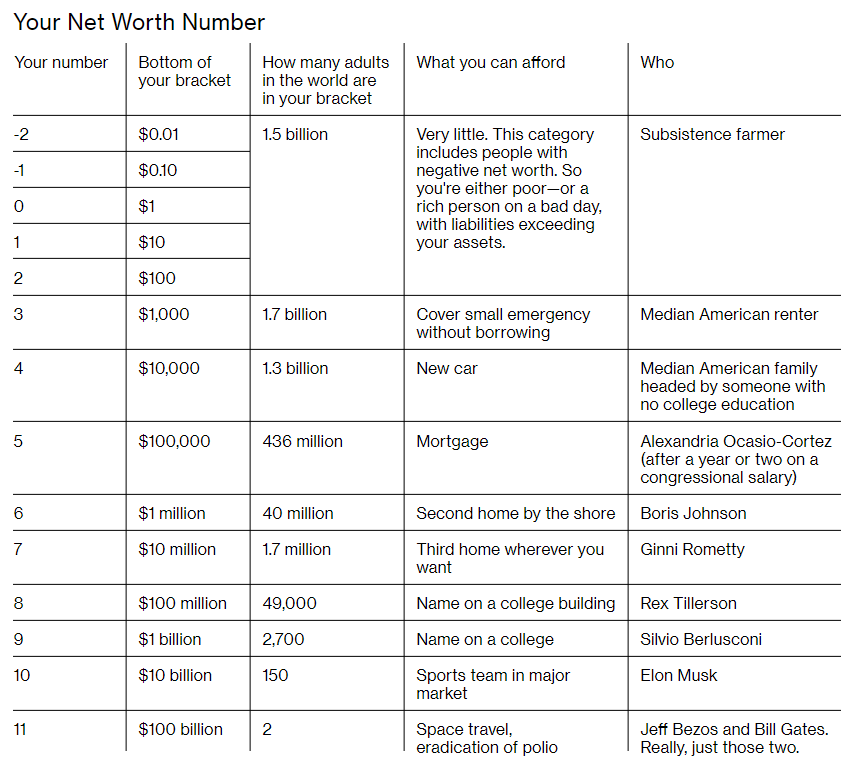

Recently, Bloomberg stepped in to address the vagaries of new worth classification. Their idea? A schematic of wealth with numeric assignments. Their scale takes everyone in the world into account and creates brackets based on net worth.

Using their chart, you can find out how many of the world’s adults have the same number as you, what you can afford to do and who may be like you.

This new index gives everyone a ranking and spans from -2 to 11.

Here’s where you have to harken back to your grade school arithmetic classes. Bloomberg’s scale was calculated using scientific notation, or powers of 10. Meaning, one million is 10 to the sixth power. So on the scale, a millionaire becomes a 6. (Here’s a spoiler: Bezos and Gates are 11s.) At the less well-to-do end of the scale, a person who has $1 in net worth is assigned a zero, while someone with a dime to his name (or one-tenth of a dollar) is a -1.

Technically speaking, a person with more debt than assets doesn’t make this list. That’s because, mathematically speaking, you can’t have a logarithm of a negative number. But for clarity and cohesiveness, Bloomberg gave these folks the designation of -2, meaning they have between one to nine cents of net worth.

Let’s take a look at their chart:

Bloomberg using data from Credit Suisse Global Wealth Report 2018 for worth numbers -2 through 8 and the Bloomberg Billionaires Index for 9 through 11. While not hard and fast numbers, through analysis of the data, they were able to estimate the number of people in each group.

Similarly, the purchasing power figures are just for illustration. They are not hard data. As an example, they say a 4 can afford a new car. Now, a new car could cost you anywhere from $10,000 to beyond $1 million. But that’s not really where the stretch comes in. It’s more the fact that, while you probably need to be a 4 to afford a new car, there are 1s, 2s, and 3s who will also succeed in buying one.

Now that we have the facts, let’s have a bit of fun with the data. Take a moment and figure out where you land on the chart. Then, think about where you were 10, 20, 30 or 40 years ago and appreciate how you’ve grown. You may have been a -1 and are now a solid 4. That’s real progress! And, if you were a 0 and now clock in as a 6, give yourself a well-deserved pat on the back.

If you’re still working and saving for retirement, see where you are and where you want to be. If you’re looking to join the 6’es, you can do it. These days, even those with modest salaries can hit that bulls-eye of millionaire-dom.

It just takes the right amount of stick-to-it-ness.

But no matter where you fall, remember that wealth is but one piece of the pie that is a happy retirement. While we all want to ensure we live comfortably during our Golden Years, this goal can be achieved on a range of Bloomberg’s scale numbers. So, you don’t need fantastic riches to have a fantastic retirement. You simply need a level of wealth that’s comfortable for you, whatever your number is.

1 Comment